Nvidia (NASDAQ:NVDA) has carved out a dominant niche in the AI revolution, commanding nearly 90% of the data center market. Its exclusive CUDA software gives it a distinct edge, making it increasingly difficult for existing customers to transition to other chip providers going forward.

However, even the most optimistic analysts recognize that triple-digit year-over-year growth can’t go on forever. Critics point to a range of concerns, from Nvidia’s heavy dependence on a few major megascalers and a possible slowdown in AI adoption to the looming risk of an antitrust investigation by the U.S. Department of Justice.

For one 5-star investor, known by the pseudonym Nexus Research, the greatest obstacle to Nvidia’s continued dominance may lie elsewhere.

“Nvidia’s biggest customers, suppliers, and competitors are all teaming up to develop an open-source alternative to CUDA, and historical technology waves suggest that the rise of open-source tends to become a force to be reckoned with,” writes Nexus Research, who is in the top 3% of TipRanks’ stock pros.

For starters, the investor looks to historical examples such as Linux and Android, where easier access, cheaper options, and widespread collaboration led to the eventual primacy of these open-source technologies.

“Open-source by nature incurs complete code transparency which essentially allows any third-party developer to customize and build upon the software, enabling speedier advancements and innovations,” Nexus Research opined.

Meanwhile, Nvidia will need to continue pouring funds into R&D spending in order to stay atop the AI race, cutting into margins that will be further pressured “as rivals’ chips catch up to become compelling alternatives.”

The combination of slowing revenue growth and weakening pricing power, according to Nexus Research, could result in a decline in Nvidia’s share price.

“It can be difficult to time these things, but we do know that the seeds have been planted for a major stock price drawdown,” the investor added.

Still, Nexus Research isn’t selling Nvidia just yet, noting the company’s “strengths beyond CUDA and the time lag until alternatively platforms commensurately catch up.” As a result, the investor has downgraded NVDA to a Hold (i.e. Neutral). (To watch Nexus Research’s track record, click here)

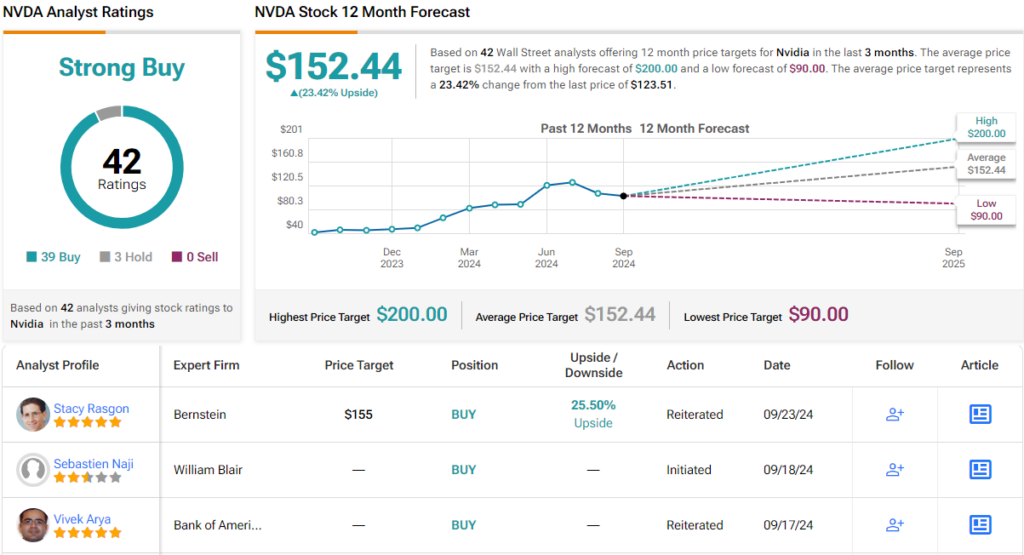

On Wall Street, however, the enthusiasm for Nvidia remains strong. The stock boasts 39 Buy ratings and just 3 Holds, making it a consensus Strong Buy. With an average 12-month price target of $152.44, NVDA is expected to deliver ~23% from current levels. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.