Amazon (NASDAQ:AMZN) offers investors the best of both worlds: the stability of a massive, well-established company combined with the rapid-fire growth rates of an agile hi-tech firm.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Its latest earnings report underscores this strength, with Amazon outperforming expectations on both revenue and earnings. The $2 trillion-plus giant saw operating income from its AWS segment soar to $10.4 billion in Q3 2024, marking an impressive 50% year-over-year growth.

Despite these impressive numbers, investor Stuart Allsopp advises caution, warning: “Amazon’s extreme valuation and already huge level of sales make it a potential candidate for a growth trap.”

Allsopp explains that a growth trap occurs when high valuations are fueled by the belief that past growth rates will continue at the same pace. When growth falls short of expectations, shares can decline sharply. The investor cites the example of Alibaba, whose shares fell some 70% over the last four years despite strong earnings growth.

In the case of Amazon, its shares are not actually priced too cheaply at present, writes Allsopp. Though Amazon’s recent spate of profits has pushed down its trailing PE ratio from 100x to 42x, the investor does not believe that it provides an accurate snapshot of the company.

Instead, Allsopp suggests that free cash flow is a more accurate measure than reported earnings, given Amazon’s high capex expenses. In addition, factoring in stock-based compensation costs raises Amazon’s effective earnings multiple to 85x. By this measure, Amazon appears pricier than major tech counterparts like Alphabet, Microsoft, Nvidia, and Apple.

After assessing Amazon’s valuation as steep, the investor turns his attention to the company’s future growth prospects.

“Companies with extremely large sales tend to grow more slowly than average,” Allsopp notes, reminding readers that Amazon is already the second-largest company in the U.S. by revenue.

“While Amazon’s earnings multiple has contracted significantly, it remains extremely expensive, particularly when we take into account surging capex and huge stock-based compensation,” concludes the investor, who rates AMZN shares a Strong Sell. (To watch Allsopp’s track record, click here)

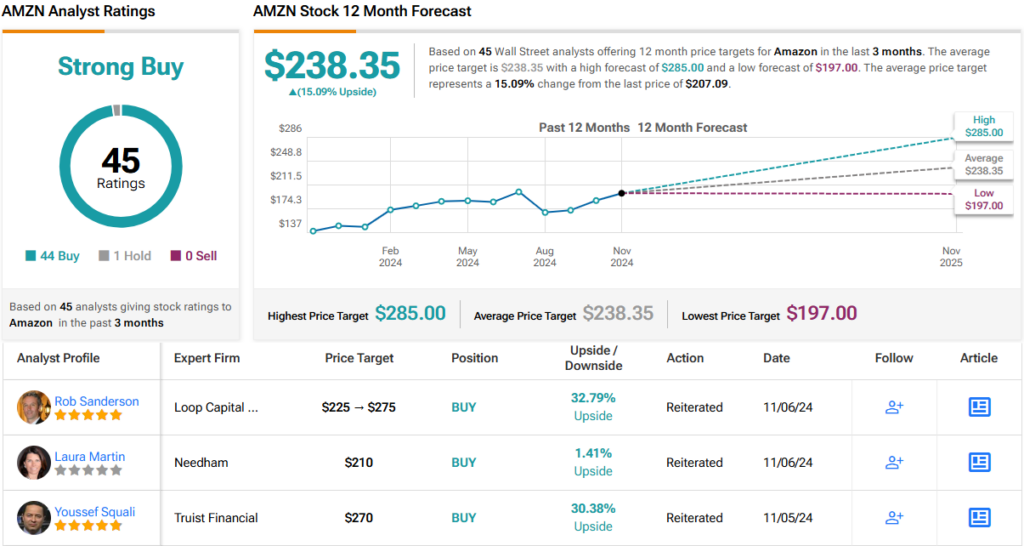

In contrast, the heavily covered stock is exceptionally popular on Wall Street. With 44 Buys and just 1 Hold rating, AMZN holds a consensus Strong Buy rating. Its 12-month average price target of $238.35 implies an upside of 15% from current levels. (See AMZN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.