Lucid Group (NASDAQ:LCID) is grappling with significant financial challenges, burning through cash at an alarming rate. With each vehicle sold, the EV maker incurs a loss of $335,311, driving its Q3 2024 losses to nearly $1 billion.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Adding to the uncertainty, the incoming administration under President Trump may pose a further risk, with potential plans to eliminate the $7,500 EV tax credit – a move that could hit LCID’s prospects even harder.

These factors have driven a nearly 50% drop in Lucid’s share price in 2024, underscoring market concerns about the company’s viability.

However, the company’s recent Q3 2024 results did offer a glimmer of optimism. The company reported a 45.4% year-over-year revenue increase, reaching $200.4 million and slightly surpassing market estimates by $2.26 million. Additionally, vehicle deliveries surged over 90% y/y, keeping LCID on course to achieve its annual production goal of 9,000 vehicles.

Still, these positive indicators have not swayed investor Victor Dergunov, who remains cautious about Lucid’s future outlook.

“Lucid’s gross margin remains negative, and without significant changes, more capital raises and further stock declines are likely,” argues Dergunov, who sits in the top 4% of TipRanks’ stock pros.

For starters, the cash burn rate of $310 million a month is a big red flag for the investor. Dergunov points out that at this pace the company would incur $3.72 billion in losses over a 12-month period.

Nor does the investor take much solace from LCID’s increasing deliveries, as the company’s losses are simply “staggering.”

“There isn’t any profitability in sight, and the company will likely need to raise more capital, resulting in more dilution and further pain for existing shareholders,” Dergunov warned. Dilution is no stranger to LCID, as the company has seen its share count practically double to 2.3 billion over the past few years.

With a valuation of $7 billion, the investor foresees plenty of “downside ahead,” potentially even a reverse split. Expecting LCID to “keep skidding lower,” the investor rates Lucid shares a Sell. (To watch Dergunov’s track record, click here)

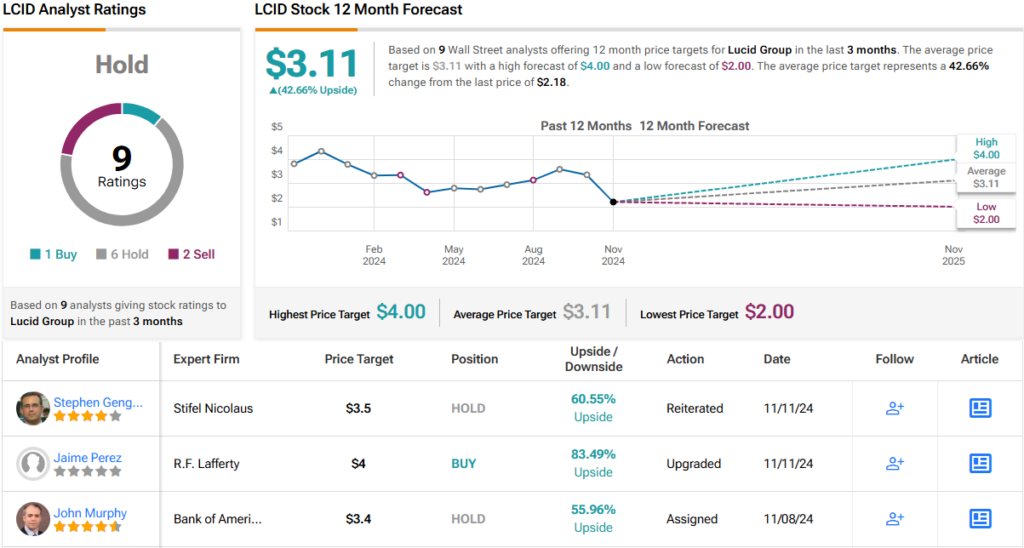

As for Wall Street’s perspective, Lucid claims a Hold (i.e. Neutral) consensus rating, based on 1 Buy, 6 Hold, and 2 Sell recommendations. However, its 12-month average price target of $3.11 implies a ~43% upside in the year to come. (See LCID stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.