SoFi Technologies (NASDAQ:SOFI) serves as a prime example of market sentiment’s unpredictability. Despite the company’s recent strong earnings – beating top and bottom line expectations, growing membership by 35%, and raising 2024 guidance – the stock fell after the news became public.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Investor James Foord believes that the market was dead wrong, and he might be right, as the shares have already rebounded since the initial dip.

“SoFi is a great long-term buy, and attractively valued,” Foord remarked.

The investor acknowledges that market expectations for SoFi may have been overly optimistic, especially given the 75% rise in the stock since its August lows. Still, he believes SoFi’s Q3 performance justifies this growth, reinforcing his confidence in the company’s upward trajectory.

Looking ahead, Foord cites two main factors driving his optimism: SoFi’s improving profitability and upcoming rate cuts.

“The company is moving towards a capital-light and fee-based model, which makes it a lot more profitable,” writes Foord, who explains that revenue from financial services doubled while expenses in this segment increased by only 20%.

The other main reason for Foord’s bullish attitude is the expected interest rate cuts. Looking at historical precedent, the investor hypothesizes that there is a good chance that this would cause short-term yields to drop while long-term yields would remain high. “This differential in the short and long end of the curve will be great for financial stocks like SoFi, as it will increase the spread in their loan books,” the investor explains.

Addressing valuation concerns, Foord refers to the consensus EPS estimates for the next three years, yielding a forward P/E of 17.76. “I think this is pretty cheap for a company in this sector and that is still growing so fast. Plus, I think there’s room for further beats and surprises given the macroeconomic context,” Foord asserts.

Sensing “significant upside potential,” Foord rates SoFi shares a Buy. (To watch Foord’s track record, click here)

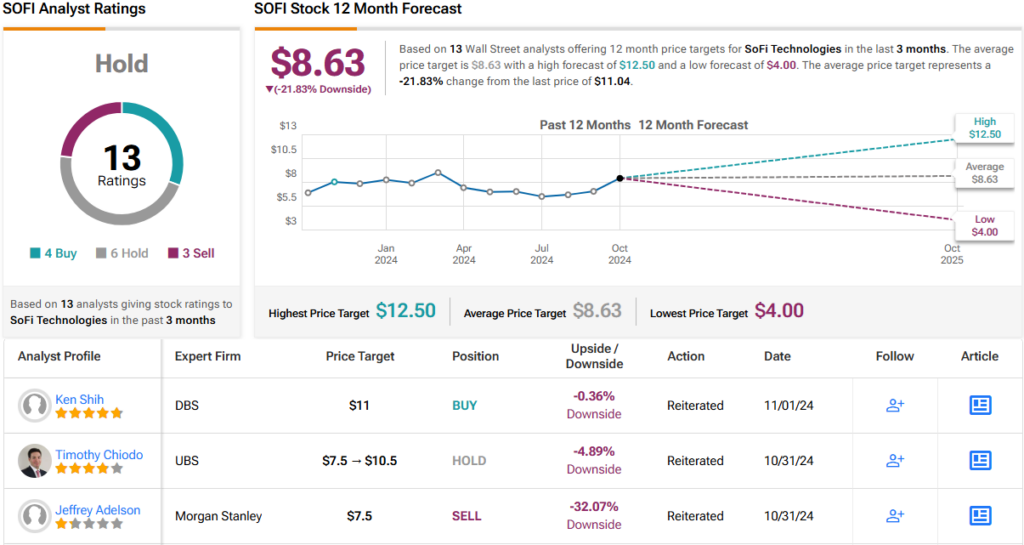

Wall Street analysts, however, remain cautious. With 4 Buy, 6 Hold, and 3 Sell ratings, SoFi holds a consensus Hold rating. Its 12-month average price target of $8.63 suggests a potential downside of ~22%. (See SOFI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.