Domino’s Pizza stock (DPZ) recorded a significant post-earnings dip last week. The largest pizza franchisor in the world has seen its shares already lose 15% of their value in the past five days despite posting strong growth across the board. The sharp decline can likely be attributed to Domino’s Q2 revenues falling short of Wall Street’s estimates. Yet, the miss is negligible to justify the ongoing sell-off, suggesting that DPZ stock could be undervalued today. Accordingly, I am bullish on DPZ stock.

Marginal Revenue Miss Overshadows Solid Revenue Growth

The primary factor behind Domino’s post-earnings sell-off appears to be its slight revenue miss relative to Wall Street expectations and a seemingly weak outlook. However, these minor shortfalls hardly warrant such a significant market reaction, especially considering the company’s robust overall performance.

Domino’s reported revenues of $1.09 billion in Q2, marking a 7.1% year-over-year increase, but this figure fell short by only $10 million, or 0.4%. While the market focused on the tiny miss, revenue growth was still strong, as Domino’s continued to execute its proven strategy of opening new stores and maximizing same-store sales.

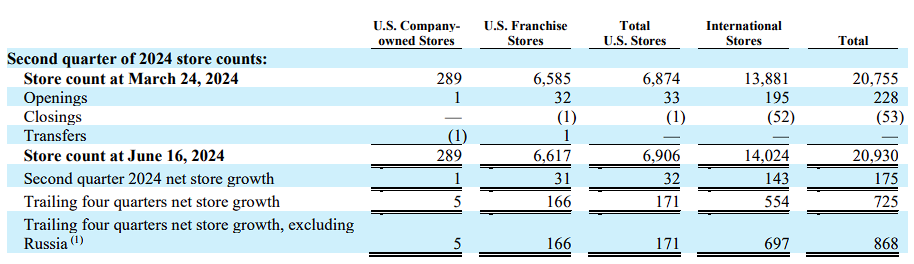

Specifically, Domino’s achieved a net opening of 175 stores globally, with 32 net new stores in the U.S. and 143 internationally, bringing the total to 20,930 stores. Further, its existing stores saw higher sales once again. Domestic company-owned and franchise stores experienced same-store sales growth of 4.5% and 4.8%, respectively. At the same time, international stores (all franchised) recorded same-store sales growth of 2.1%, excluding currency impacts.

A key driver to growth was the redesigned Domino’s Rewards program, which fueled transaction growth. The program saw a substantial rise in active members, doubling loyalty redemptions in the first half of 2024 compared to 2023. This notably increased carryout orders. Additionally, the launch of the New York Style pizza, featuring a thinner, foldable crust, diversified the menu and attracted new customers.

Finally, management credited the quarter’s success to outperforming competitors through a strong focus on customer satisfaction. A key factor in this achievement was the “MORE Delicious Operations” training sprints initiative, which aimed to enhance product quality and delivery efficiency. This initiative resulted in a nearly 10% improvement in average delivery times compared to two years ago.

Although these operational improvements often go unnoticed by investors, who typically focus on any company’s core financials, I believe they are essential to long-term brand success. It is strange, therefore, that the market fixated on the 0.4% revenue shortfall and failed to recognize the many improvements made during the quarter.

Earnings Growth Was Truly Impressive

Another puzzling aspect of Domino’s recent stock sell-off is its excellent earnings growth. The company’s earnings per share (EPS) surged to $4.03, celebrating a 30.8% increase year-over-year and beating Wall Street’s expectations by $0.35. This outsized growth is largely due to Domino’s business model, where nearly all of its locations are franchised. This structure enables the company to significantly enhance its profit margins, even with modest revenue growth.

With over 99% of its locations franchised, Domino’s primarily collects royalties that flow directly to the bottom line, as these revenues don’t come with incremental costs. This model leads to a constant profit margin expansion as the company scales. Indeed, Domino’s net income margin improved by 220 basis points to 12.9%. Combined with a 7.1% increase in sales and a slight drop in the number of shares outstanding, the company was able to post a nearly 31% increase in EPS, as just mentioned.

The Valuation Appears Attractive

Following Domino’s prolonged sell-off, I believe the stock’s valuation has reached rather attractive levels. At a forward P/E of 24.6x, Domino’s valuation hovers below its 10-year average, while consensus estimates still expect a robust EPS compound annual growth rate of 11.8% over the next five years. Given enduring double-digit EPS growth ahead and Domino’s highly scalable business model, I believe the stock is set for strong gains from its current price.

Is DPZ Stock a Buy, According to Analysts?

Looking at Wall Street’s sentiment on the stock, Domino’s Pizza features a Moderate Buy consensus rating based on 18 Buys, nine Holds, and one Sell assigned in the past three months. At $521.04, the average DPZ stock price target suggests 23.2% upside potential.

If you haven’t yet decided which analyst to follow to buy or sell DPZ stock, consider checking out Chris O’Cull from Stifel Nicolaus. Over the past year, he has consistently shown outstanding performance, boasting a strong average return of 23% per rating with a success rate of 83%. Click on the image below to learn more.

The Takeaway

Despite a harsh dip in Domino’s Pizza stock, driven by what appears to be a minor revenue miss and a seemingly weak outlook, the company’s overall performance highlights an undervalued opportunity. With a 7.1% boost in revenue, an even more remarkable 30.8% growth in EPS, and operational improvements, the market’s reaction appears out of touch with reality. Regardless, the bulls can capitalize on this development, as the stock’s post-sell-off valuation likely presents a compelling buying opportunity.