Pfizer (PFE) has long been a staple in the portfolios of income-oriented investors, especially those drawn to its consistent dividend history and high-margin cash flows. Today, Pfizer comes with a dividend yield of about 5.9%, substantially higher than where it’s stood for most of the past 15 years. The rising dividend has been a product of PFE stock’s prolonged share price decline over the past few years. This makes PFE an appealing option at first glance, especially for investors seeking above-average income from a well-established healthcare giant. Nevertheless, despite the seemingly attractive dividend, there are risks associated with Pfizer that warrant careful consideration. Ultimately, I hold a neutral stance on the stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

A Compelling Dividend Yield, But There is More to the Story

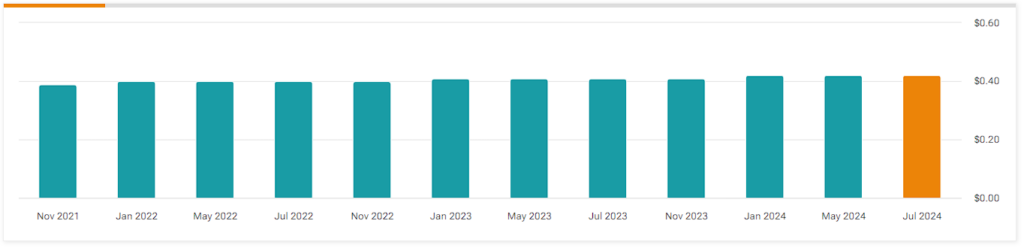

Pfizer is well-known among income-oriented and dividend growth investors, particularly for its impressive streak of 13 consecutive years of dividend increases. Meanwhile, its present yield of 5.9% stands at one of the highest levels of that period, making the stock particularly interesting for those seeking dividend income from a quality company in healthcare. Yet, this is only part of the story. Pfizer’s ability to maintain and grow its dividend has been impacted by several challenges that have diluted its appeal lately.

Slowing Dividend Growth is a Concern

A red flag that immediately stands out when evaluating PFE as an investment is its slowing dividend growth. Over the past decade, the dividend’s Compound Annual Growth Rate (CAGR) has steadily slowed. Its 10-year dividend CAGR stands at 4.9%, which drops to just 3.1% over the last five years. The most recent dividend increase of just 2.4% further underscores the sustained slowdown.

While dividend growth investors often look for consistency, I believe that this clear trend of weakening growth dampens expectations for future increases. The dividend growth rate is already below the level of inflation and, as we will see in a moment, Pfizer’s lagging financials suggest that this trend isn’t likely to change anytime soon.

Stagnating Revenues and Earnings Hamper Future Prospects

Consistent with its trend of slowing dividend growth in recent years, Pfizer’s revenue and earnings over the past decade have been lackluster, with no clear catalysts on the horizon to reignite growth. Pfizer’s numbers show that growth has been stagnant for years, excluding the temporary boost from its COVID-19 vaccine, Comirnaty (Pfizer’s COVID-19 vaccine, co-developed with BioNTech) and Paxlovid (Pfizer’s COVID-19 antiviral treatment). Excluding these pandemic-driven short-term boosts, Pfizer’s core operations have struggled to generate consistent growth.

In particular, Pfizer saw its revenues plunge by 42% in Fiscal 2023 as demand for the above COVID-related products declined sharply. Excluding those COVID-linked products, sales would have grown by 7%. Last year’s revenues of $58.5 billion are below its 2010 and 2011 levels and not that much higher than the annual revenues posted most the past decade, excluding the years of the pandemic.

Pre-pandemic, Pfizer’s growth was already subdued, with operating income failing to deliver a consistent upward trend as well. The main reasons for this stagnation include the loss of exclusivity on several critical drugs and intensifying competition from generic products and newer entrants in the biopharma space. For context, the $5.26 billion in operating income posted last year was the worst result since 1998.

Rising Debt Suggests Pfizer’s Dividend and Overall Growth Prospects Remain Soft

Looking forward, I hold doubts that the company will be able to reverse this trend, especially with its growing debt adding an additional layer of risk. In the past couple of years, Pfizer’s net debt has surged above $64 billion from less than $10 billion a few years ago. The primary driver behind this explosive increase in indebtedness is the $43 billion acquisition of Seagen in 2023. With that acquisition, the company sought to bolster its oncology portfolio, likely in attempt to offset declining COVID revenues.

Of course, the Seagen acquisition does offer long-term growth potential. However, there’s no guarantee that this will materially aid Pfizer, especially in the short term. Last year, Seagen’s revenues were just $2.1 billion, while the company posted a loss of nearly $650 million. Moreover, Pfizer’s increased debt has already resulted in notably higher interest expenses, which further compress its profitability and its dividend growth prospects. In fact, I would argue that Pfizer may pause dividend increases altogether as management attempts to deleverage.

Is PFE Stock a Buy, According to Analysts?

Pfizer stock features a Moderate Buy consensus rating from Wall Street today, based on seven Buys and and 11 Holds assigned in the past three months. At $32.75 the average PFE stock price target implies about 12% potential upside.

If you’re unsure which analyst to trust the most regarding Pfizer, Vamil Divan is the most accurate analyst covering PFE stock (on a one-year timeframe). He boasts a 76% success rate.

Conclusion

Pfizer’s 5.9% dividend yield may initially attract income-focused investors, but several risks cloud its long-term appeal. Slowing dividend growth, stagnant revenues, and rising debt pose significant challenges to its ability to sustain or grow payouts. The sharp decline in pandemic-related revenues clearly highlights Pfizer’s struggle to generate continued organic growth. While the Seagen acquisition could strengthen future prospects, its immediate impact seems limited, especially given mounting debt. Therefore, I believe that caution is warranted, and I remain neutral on PFE stock despite its high yield.