Advanced Micro Devices (NASDAQ:AMD) stock has gained 57.3% over the past 12 months, driven by strong demand in the Data Center segment. However, many investors are split as to whether AMD’s premium valuation is really justified. Personally, I’m not convinced by the company’s expected growth rate, with forecasts inferring that AMD will increasingly compete with Nvidia (NASDAQ:NVDA) in the lucrative data center and artificial intelligence (AI) space. As such, I’m neutral on the stock for now.

A Resurgent AMD

First, it’s worth noting that Lisa Su, CEO of AMD, has been instrumental in revitalizing the company since 2014. This is highlighted by the surging share price, which has advanced 38x over the past decade. Under her leadership, AMD has significantly improved its financial performance, launched competitive products like the Ryzen processors, and expanded into high-performance computing (HPC) and graphics.

As noted by Meridian Funds’ Q4-2023 investor letter, “Our research identified that changes and investments made by current management under CEO Lisa Su had, over several years, finally resulted in compelling technology that positioned AMD as a stronger competitor to Nvidia and that its latest products were superior to Intel’s (NASDAQ:INTC).”

Many would argue that it is because of Su’s effective management and innovation-focused approach that AMD is now frequently mentioned among the top tech companies, rivaling Nvidia on several technological fronts.

Is AMD Winning In Data Centers and AI?

In the first quarter, AMD reported revenue of $5.5 billion. This represented a mere 2% increase YoY, with an 80% rise in Data Center revenue — reaching $2.3 billion — being offset by a fall in revenue from Gaming and Embedded segments. Interestingly, while the Data Center segment hit new heights, revenue generated from the segment was only up 2% sequentially, although this may represent a seasonal downturn in the CPU market.

AMD has a strong portfolio of products in the AI segment, notably its MI300 series which is the company’s flagship for HPC and AI. There’s no getting away from the company’s impressive offering here, and that’s evidenced by the fact that the Frontier supercomputer housed at Oak Ridge National Lab — powered by AMD EPYC CPUs and AMD Instinct GPUs — has been the fastest supercomputer in the world for three straight years.

According to cudocompute.com, AMD’s MI300 series of AI accelerators can compete with Nvidia’s H100 family of accelerators from a technological standpoint, although the latter may have an advantage in AI and ray-traced rendering performance. The MI300’s capabilities are also evidenced by its use in powering Microsoft’s (NASDAQ:MSFT) Azure OpenAI servers.

AMD says it is seeing strong demand for the MI300 and expects GPU revenue to exceed $4 billion in 2024, up from the $3.5 billion guided in January. Su said this was because the ramp-up of the MI300 was going well and that feedback from customers had given management confidence going into the second half of the year.

However, despite this technological pedigree, AMD remains a long way behind Nvidia in terms of market share and revenues. And it could well stay that way. With cash flow soaring, Nvidia is investing around 1.5x more in research and development than AMD. Several analysts have argued that AMD will have to settle for second place in this highly lucrative market.

Can AMD Justify Its Valuation?

AMD trades at 61.39x non-GAAP TTM earnings and 46.81x non-GAAP forward earnings. This makes it rather expensive but, interestingly, marginally cheaper than Nvidia on these near-term metrics.

Moreover, according to the analysts providing earnings forecasts for the stock, AMD is actually expected to grow faster than Nvidia. AMD’s earnings per share are expected to come in at $3.50 in 2024, and this surges to $9.47 by 2027.

In turn, this also leads to a price-to-earnings-to-growth (PEG) ratio of 1.07x, which is very attractive for the segment. The caveat, of course, is that growth forecasts aren’t always correct, especially in fast-moving sectors where client adoption could drastically impact the company’s earnings trajectory.

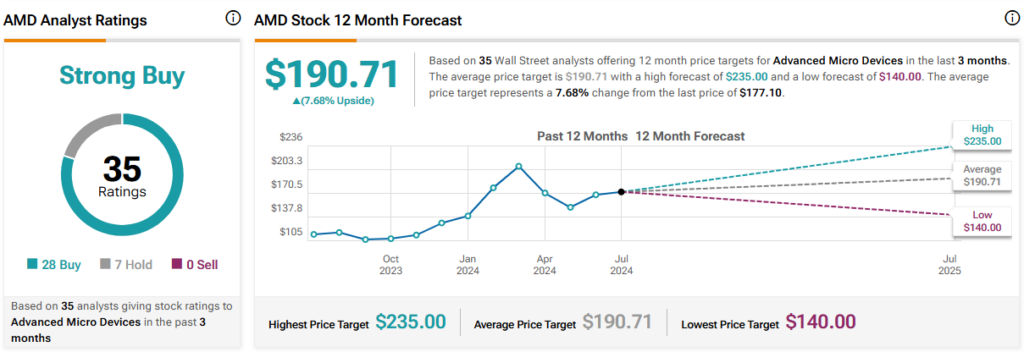

Is AMD Stock a Buy, According to Analysts?

On TipRanks, AMD comes in as a Strong Buy based on 28 Buys, seven Holds, and zero Sell ratings assigned by analysts in the past three months. The average AMD stock price target is $190.71, implying 7.7% upside potential.

The Bottom Line on AMD Stock

AMD is an exciting company to invest in. It’s at the forefront of technological developments in data centers and AI. However, analysts believe it will be hard for the Santa Clara-based company to surpass its peer, Nvidia — incidentally run by Su’s first cousin once removed — given Nvidia’s cash flows and its capacity to outspend AMD on research and development.

However, the forecasts suggest that AMD’s earnings in the medium term will be enough to justify its valuation. While analysts are bullish on AMD, with zero Sell ratings, I’m struggling to put my money behind a company that is playing catch up with Nvidia. Yes, there’s an opportunity for AMD to gain market share, but Nvidia is a formidable peer.