Software company DocuSign (NASDAQ:DOCU) will release its first quarter Fiscal 2025 financial results on Thursday, June 6. Improving momentum across its business, a strong customer retention rate, high usage of its products among existing customers, and new customer wins will likely support its top line. Moreover, the company’s focus on efficiency and improving productivity will likely cushion its bottom line.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

With this backdrop, let’s delve into analysts’ estimates for DocuSign, whose core product offerings include electronic signatures.

DocuSign: Q1 Expectations

Wall Street expects DocuSign to report revenue of $707.33 million, which is near the higher end of management’s guidance and reflects a year-over-year growth of about 7%. The company’s top line could benefit from increased business from its customers signing and renewing multiyear, multimillion-dollar contracts.

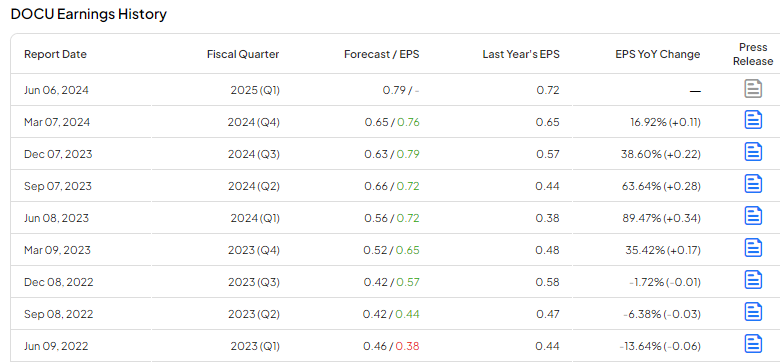

Wall Street analysts expect DocuSign to report earnings of $0.79 per share in Q1, up about 10% year-over-year. The company’s strategic initiatives to improve efficiency will drive its EPS. TipRanks’ earnings page shows that DOCU has consistently surpassed the Street’s EPS expectations in the past seven consecutive quarters.

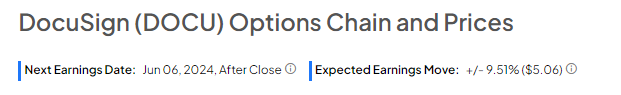

Options Traders Expect a Significant Move

Using TipRanks’ Options tool, we can observe traders’ expectations for the stock’s movement following its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. While this may seem complex, the Options tool simplifies the process. This indicates that options traders expect a significant 9.51% movement in either direction.

Is DocuSign a Buy, Sell, or Hold?

Wall Street analysts remain sidelined on DocuSign stock ahead of Q1 earnings. The stock has three Buys, 11 Holds, and two Sell recommendations for a Hold consensus rating.

DocuSign stock is down about 10.5% year-to-date. Analysts’ average price target on DOCU stock is $66.77, implying an upside potential of 25.51% from current levels.

Bottom Line

Analysts’ estimates suggest that the company is expected to see positive momentum in Q1, driven by strong customer retention, growing product usage, and new customer acquisitions. Additionally, DocuSign’s emphasis on efficiency and productivity improvements will likely bolster its profitability.