Shares of Dollar Tree (DLTR) plunged in pre-market trading after the company’s Q2 results and guidance left investors disappointed. In the second quarter, the discount price retailer reported adjusted earnings of $0.67 per diluted share, a decline of 26.4% year-over-year, which fell short of Street expectations of $1.04 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s revenues inched by 0.7% year-over-year, reaching $7.37 billion. However, this figure still missed analysts’ estimates of $7.49 billion. Additionally, DLTR’s same-store sales at its Dollar Tree locations rose by just 1.3% in the second quarter.

The company attributed the disappointing results to a challenging macro environment.

Dollar Tree Is Exploring Restructuring Options

Dollar Tree has been restructuring its business, and in April, the company announced that it was exploring various options. This included the potential sale or spinoff of its Family Dollar business.

Earlier this year, Dollar Tree revealed plans to close 970 Family Dollar stores. By August 3, the company had already shuttered around 655 of these stores, with plans to close an additional 45 by the end of the year.

DLTR Issues a Weak FY24 and Q3 Outlook

Looking ahead to FY24, Dollar Tree has revised its net sales forecast to between $30.6 billion and $30.9 billion, down from the previous range of $31 billion to $32 billion. The company also expects comparable net sales growth in the low-single-digits across its enterprise, including both Dollar Tree and Family Dollar segments. Adjusted diluted earnings per share is now anticipated to range from $5.20 to $5.60, compared to the prior forecast of $6.50 to $7 per share.

For the third quarter, Dollar Tree projects adjusted diluted earnings between $1.05 and $1.15 per share, with revenues expected to fall between $7.4 billion and $7.6 billion. For reference, analysts had forecast earnings of $1.32 per share and revenues of $7.6 billion.

Is DLTR a Good Stock to Buy?

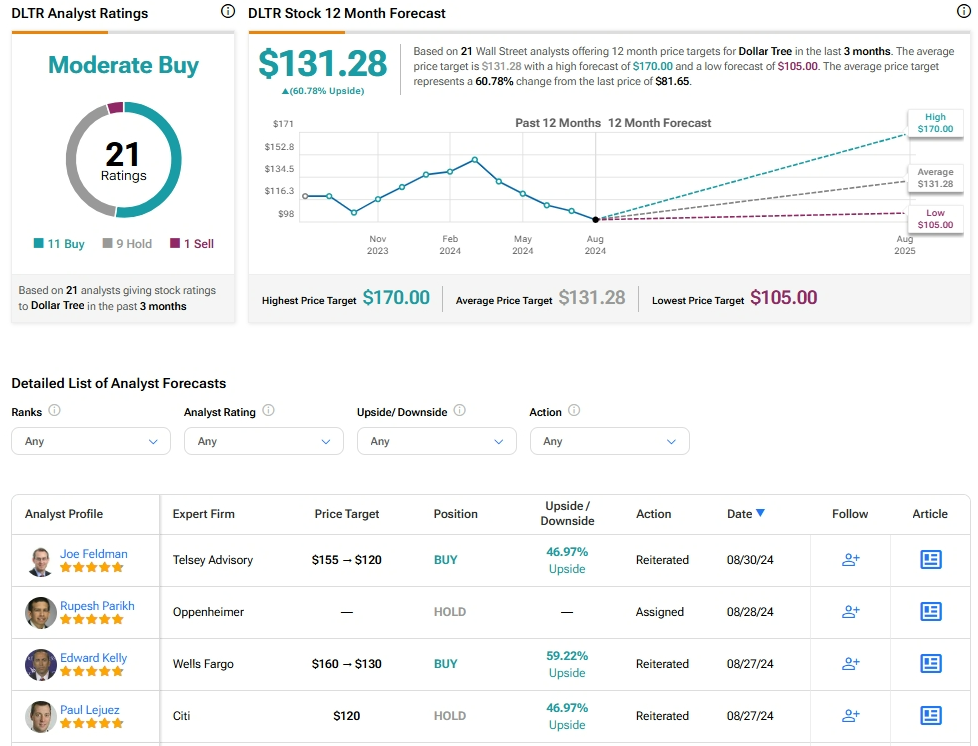

Analysts remain cautiously optimistic about DLTR stock, with a Moderate Buy consensus rating based on 11 Buys, nine Holds, and one Sell. Year-to-date, DLTR has plunged by more than 40%, and the average DLTR price target of $131.28 implies an upside potential of 60.8% from current levels. These analyst ratings are likely to change following DLTR’s results today.