Dick’s Sporting Goods (DKS) stock surged higher today after the sporting goods retailer posted its Q1 earnings report.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Wellness Demand

It posted adjusted earnings per share of $3.37 for the quarter ended May 3, 2025, surpassing analyst estimates of $3.20. Revenue climbed 5.2% year-over-year to a record $3.17 billion, exceeding the consensus forecast of $3.12 billion.

Comparable store sales increased 4.5% year-over-year, marking the fifth consecutive quarter of over 4% growth. It has been helped by growing interest in and demand from consumers for sport, health and wellness.

It has also been boosted by its House of Sport premium stores brand.

DKS stock was up over 5% in pre-market trading. However, it is down 23% in the year to date mostly down to investor concerns over its proposed $2.4 billion takeover of rival Foot Locker.

Although the deal will allow DKS to enter international markets it is buying a business that’s been in poor condition for a number of years. Indeed, Foot Locker has struggled since the Covid-19 pandemic shutdown its stores or forced them to operate at reduced capacity.

DKS Forward Guidance

DKS also cheered investors by reaffirming its 2025 outlook despite general consumer uncertainty. It is expecting earnings per share to be between $13.80 and $14.40 in fiscal 2025 — in line with the $14.29 expectations.

It’s expecting revenue to be between $13.6 billion and $13.9 billion, which is also in line with forecasts of $13.9 billion.

“This reflects our strong start to the year and confidence in our strategies and operational strength while still acknowledging the dynamic macroeconomic environment,” CEO Lauren Hobart said.

KPI data shows how well its revenues have grown over the last few years.

Is DKS a Good Stock to Buy Now?

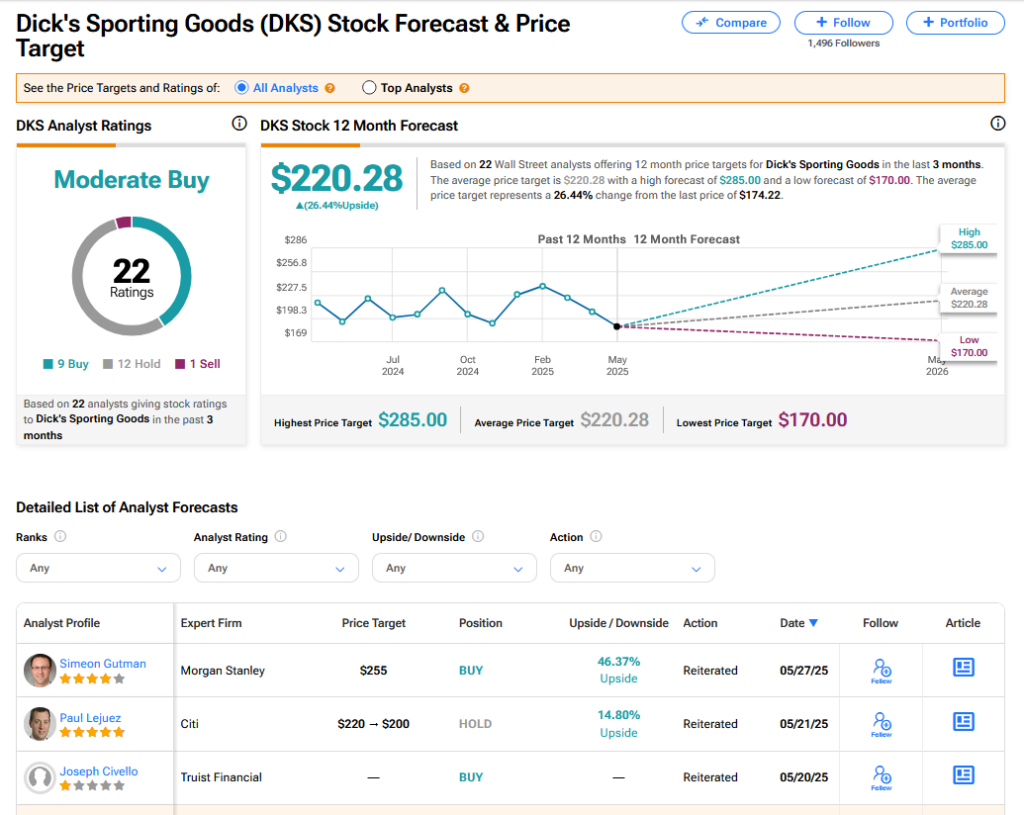

On TipRanks, DKS has a Moderate Buy consensus based on 9 Buy, 12 Hold and 1 Sell rating. Its highest price target is $285. DKS stock’s consensus price target is $220.28 implying an 26.44% upside.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue