The Walt Disney Company (DIS) is set to report its Fiscal Q4 earnings on November 14th. Although the stock has dropped 26.21% over the past five years, Disney’s de-risked valuations and strong momentum in its streaming business create a bullish outlook for Q4 and beyond. It has been doing so despite ongoing pressure on its key Parks & Entertainment segment, which faces short-term challenges from softer consumer spending and other external factors.

In this article, I’ll examine Disney’s performance this year, review the last quarter, and discuss what investors should look for in the upcoming earnings report that could spark a more bullish reaction in DIS stock.

Recap of Disney’s Latest Earnings

Before diving into the reasons for my more optimistic outlook on Disney, let’s review the company’s performance in its most recent Fiscal Q3 earnings. In August, the Burbank, California-based company exceeded analysts’ expectations, reporting EPS of $1.39, compared to the anticipated $1.19, and revenues of $23.2 billion, slightly ahead of the projected $23.1 billion. While the stock is still about 20% below its all-time highs from April this year, it has rallied roughly 15% since hitting its lows in August.

Several factors have weighed on Disney’s performance this year, particularly the slowdown in the Parks & Experiences segment, which has been a key profit driver for the company. Last year, this division accounted for 70% of Disney’s segment profits, but this year, it is on track to contribute around two-thirds. In fiscal Q2, Disney predicted strong results for this segment, and in Q3, it expected growth in operating income. However, that forecast did not materialize.

In Q3, operating income from U.S. parks dropped by 6%, while international parks saw a 2% increase. Disney attributed the decline in domestic park profits to inflation-driven cost increases, higher technology spending, and new guest offerings. The company projects mid-single-digit profit declines in the Parks & Experiences segment in Q4, with pressures continuing through the first three quarters of next year.

High Hopes for Disney’s Streaming Success

Arguably, the core of Disney’s bullish thesis centers around the company’s entertainment business, specifically the point at which direct-to-consumer (DTC) profitability surpasses that of its linear networks.

Currently, linear networks are Disney’s main profit driver, though they are experiencing a gradual year-over-year decline. For instance, operating income from linear networks dropped 6%, from $1.02 billion to $966 million. However, a key turning point came with Disney’s direct-to-consumer segment, which saw its losses shrink from $505 million to just $19 million.

The narrative surrounding Disney stock is expected to shift dramatically around this tipping point. This will likely occur as Disney continues to bundle its services, raise prices, reduce churn, and drive subscriber growth. Direct-to-consumer revenue increased 15% year-over-year, and the segment’s revenue is already more than double that of the linear networks.

Looking at Netflix (NFLX) as a comparison, it’s clear that a streaming-first business model can be highly profitable. In fact, Disney’s combined direct-to-consumer streaming business, including ESPN+, posted a $47 million profit in Q3, surpassing the company’s prior guidance by one quarter and marking its first-ever profit. With this trajectory, Disney’s streaming business is poised to steadily move toward greater profitability. It’s not unrealistic to expect that, in five years, Disney could generate hundreds of millions of dollars in quarterly profit, especially given the company’s projected three-to-five-year EPS CAGR of around 13.3%.

What to Expect from Disney’s FQ4 Earnings

As Disney’s FQ4 earnings approach, scheduled for release on November 14 before the market opens, my bullish stance is partly based on expectations that this could be the quarter with the highest yearly growth rates in both earnings and revenue over the next nine quarters, at least.

The consensus expects EPS to come in at $1.10, marking a 35% year-over-year increase, which is quite significant. On the revenue side, analysts anticipate $22.49 billion, a 5.9% annual increase. Interestingly, since Disney reported its Fiscal Q3 earnings in August, 10 of 12 analysts have revised their EPS estimates down, while 8 out of 12 have raised their revenue forecasts.

What Makes DIS Stock a Buy Today

While I’m optimistic about Disney’s long-term prospects and believe this could be an ideal time to own some shares—especially considering its current EV/EBITDA of 13.5x, about 50% below its five-year average—it’s difficult to predict the stock’s movement immediately following its Fiscal Q4 results. The company is still in a transitional phase, working to boost profitability in its DTC business while facing headwinds from softer consumer spending in its Parks and Entertainment segments, which continue to account for most of its revenue.

As Disney CFO Hugh Johnston put it, under CEO Bob Iger’s leadership since 2022, the company has refocused on producing higher-quality content in the movie business rather than churning out a high volume of titles to meet budget targets. This shift is necessary because the previous strategy of producing lower-impact content led to decreased reception and hurt other releases, while also resulting in losses from large-scale production. Therefore, I believe that if Disney reports another strong quarter in its DTC business, it will be a key bullish signal for the long-term thesis.

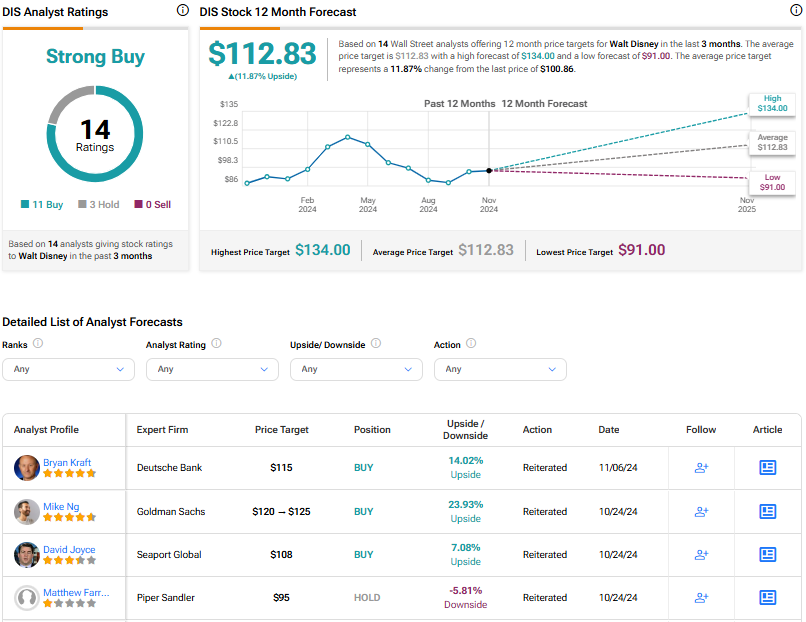

My optimism is also reflected in Wall Street’s outlook: the consensus is a Strong Buy, with 11 out of 14 analysts recommending a Buy and just three maintaining a Neutral rating. The average price target is $112.83, suggesting a potential upside of 11.87%.

Conclusion

Despite some short-term challenges in its Parks & Experiences segment, I’m bullish on Disney. The company’s strong direct-to-consumer business and focus on high-quality content position it well for long-term growth. The upcoming earnings report is expected to show solid year-over-year growth in both revenue and earnings. I’m giving Disney a Buy rating with a compelling valuation and signs of positive momentum in streaming.