The investment thesis for Disney (DIS) today offers little reason for me to adopt anything other than a neutral stance. The company has struggled for several years, facing intense competition, squeezed margins, and significant debt, all of which have contributed to a steep decline in its share price. The recent sell-off following its Fiscal Q3 results further underscores this ongoing trend.

Despite improvements in its recent results, particularly in its Streaming business, I still see several headwinds targeting its most profitable segment—Parks & Experiences (amusement parks). This segment is heavily impacted by consumer spending and pricing trends, which are difficult to reverse in the short term and raise concerns for the long-term outlook.

Weak Consumer Spending Casts a Shadow Over Disney’s Future

My skepticism about Disney’s investment thesis deepened after the company’s FQ3 results.

Although the Burbank, California-based company exceeded analysts’ expectations with EPS of $1.39 versus the anticipated $1.19 and revenues of $23.2 billion compared to the projected $23.1 billion, the stock has continued to decline since reaching its yearly high in April.

The significant issue lies in the slowdown of the Parks & Experiences segment, which was one of the company’s most critical divisions. Last year, Parks & Experiences accounted for 70% of Disney’s segment profits, and this year, they are on track to contribute around two-thirds. In Fiscal Q2, Disney had predicted robust results for this segment in Fiscal Q3, with growth in operating income. However, that did not materialize.

Operating income for U.S. parks decreased by 6%, while international parks saw a 2% increase. Disney attributed the decline in operating income at its domestic parks to inflation-driven cost increases, higher technology spending, and new guest offerings.

Now, Disney projects that this segment’s profits will decline by mid-single digits in the fourth quarter, with pressures persisting through the first three quarters of next year. This rapid and substantial shift has certainly raised concerns among the bulls.

A significant factor behind this is the decline in domestic consumer spending, a trend previously observed with Comcast’s (CMCSA) Universal Parks and now confirmed with Disney. This undermines the positive momentum in Disney’s Direct-to-Consumer business, which is central to its growth story.

It’s important to note that, according to the company’s filings, the main risks associated with investing in Disney stem from “further deterioration in domestic and global economic conditions.” Consequently, in times of economic slowdown, Disney’s stock is likely to face continued skepticism, with bearish sentiment prevailing while these headwinds persist.

Can Disney’s Streaming Success Offset Challenges in Theme Parks?

Despite some challenges, not everything is negative within Disney’s investment thesis. In Fiscal Q3, the company still reported 4% revenue growth and a 35% increase in EPS. As a result, Disney raised its EPS guidance for the year to 30% growth, indicating that the situation is far from dire.

One of the most positive aspects of the quarter was the performance of Disney’s Streaming unit (Disney+, Hulu, and ESPN+), which turned a profit for the first time. Management had projected profitability for Fiscal Q4, but it arrived earlier than expected. The Streaming business posted an operating profit of $47 million compared to a loss of $512 million in the previous year, as you can see in the image below.

However, it’s important to note that excluding the contribution of ESPN+, the Direct-to-Consumer Streaming unit actually reported a loss of $19 million.

The critical question is whether the strength in streaming can compensate for the decline in Disney’s traditional business, particularly in its amusement parks. Looking at the broader picture, in the Entertainment segment—which includes Linear Networks, Direct-to-Consumer streaming, and Content Sales—revenues for the quarter came in at $10.6 billion compared to $8.4 billion from the Experiences segment, which includes theme parks.

Even though Entertainment generates more revenue, it lags in operating margins, producing $1.2 billion in operating income compared to $2.2 billion from Experiences. Still, there is undeniable progress in the Entertainment segment, and if Disney can improve its margins here, it could lead to more robust profitability in the future.

One of the key challenges for Disney’s Entertainment segment is managing pricing. Inflation has driven the company to increase subscription fees, which could result in higher subscriber churn. Beginning in mid-October, Disney plans to raise the monthly prices for Disney+, Hulu, and ESPN+ by $1 to $2, with Hulu seeing a more significant increase of $6 per month. Although these price hikes may spark some customer dissatisfaction, they are anticipated to drive short-term revenue growth.

Given that direct-to-consumer (DTC) streaming is central to Disney’s growth strategy, the path forward is complex, and even recent advances may face headwinds that could challenge this growth narrative.

On the positive side, Disney currently trades at a relatively de-risked valuation, with a forward EV/EBITDA multiple of 11.4x, nearly half the average it has traded at over the last five years. However, the uncertainty surrounding consumer spending trends impacting the Experiences segment, along with the company’s future reliance on DTC, justifies the discounted multiple.

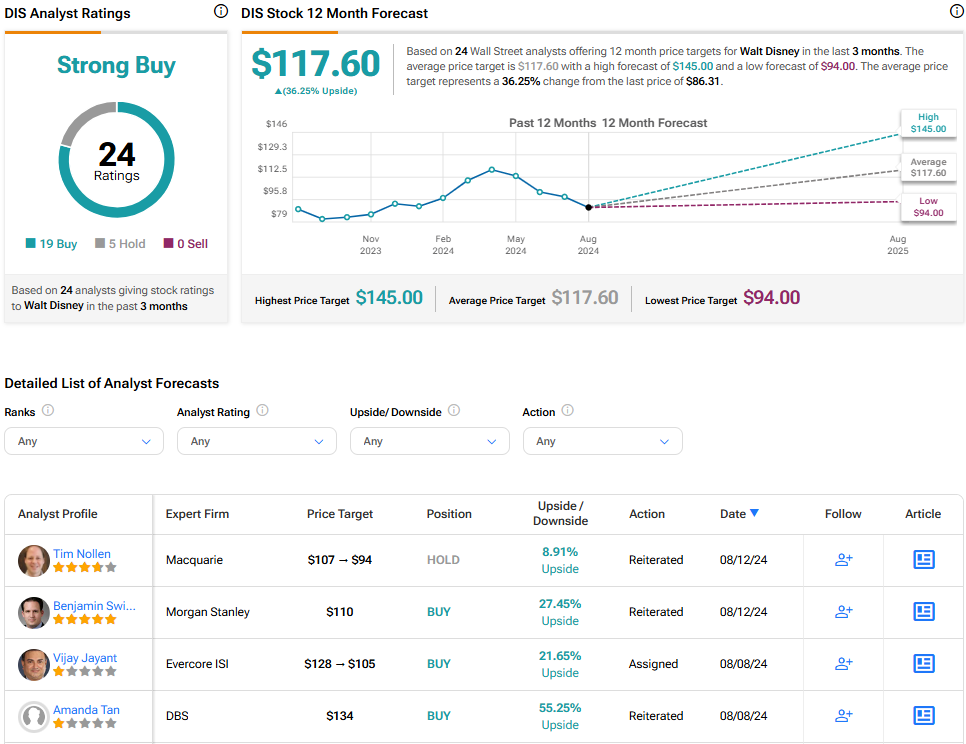

Is DIS Stock a Buy, According to Analysts?

While the general Wall Street consensus on Disney remains bullish with a Strong Buy rating, some analysts have trimmed their price targets following the Q2 results. For example, Evercore ISI’s Vijay Jayant reduced his price target from $128 to $105. However, the average DIS stock price target among the 24 analysts covering it is $117.60, which still suggests significant upside potential of 36.3%.

Key Takeaways

Disney’s investment outlook is mixed, with some recent improvements in its Streaming segment but significant ongoing challenges in its core Parks & Experiences business due to declining consumer spending and rising costs. While the company trades at a discounted valuation and analysts see potential upside, the pressures on its most profitable segments and reliance on streaming for future growth suggest caution. Given these uncertainties, maintaining a neutral stance appears prudent.