So, Disney’s (DIS) recently launched D23 event brought some new plans for the entertainment giant, but not all of its plans have fared so well. One field in particular, Disney’s streaming operations, is crying out for a “complete rethink,” according to Lukasz Tomicki with LRT Capital Management. Investors, meanwhile, were less concerned as Disney shares were up nearly 1.5% in Monday afternoon’s trading.

Tomicki pointed out that Disney is not really one business but a collection of several in one. And its streaming operations are something of a mixed bag right now, particularly considering ESPN. ESPN is a “wonderful” business, he noted, but it is more of a “melting ice cube” right now. Tomicki pointed to margins in open decline and a lot fewer people interested in paying for such services than they were previously.

Then there is the matter of costs; more options to watch sports mean more potential buyers for sports rights, which will send the prices up accordingly. And that led to Tomicki declaring that Disney needs that “complete rethink” of not only how to create content, but how to even define it to begin with.

The Villains Park

We knew the Brazilian D23 event would offer updates on the parks, but one update in particular caught a lot of attention. “Very, very soon,” Disney officials noted, the Villains Land attraction would start construction and feature “…so much fiendish fun,” according to a Fox Business report.

A promotional image from the event revealed who would be involved in the park and featured a who’s who of Disney antagonists ranging from Aladdin‘s Jafar to 101 Dalmatians‘ Cruella De Vil. The specifics have not been released yet and the promotional images used were taken directly from the Disney Lorcana trading card game, so their exact connection to the park is up in the air.

Still, with this and several other parks set to emerge, Disney may be looking for a way to put life back into its ailing theme park business.

Is Disney Stock a Buy or Hold?

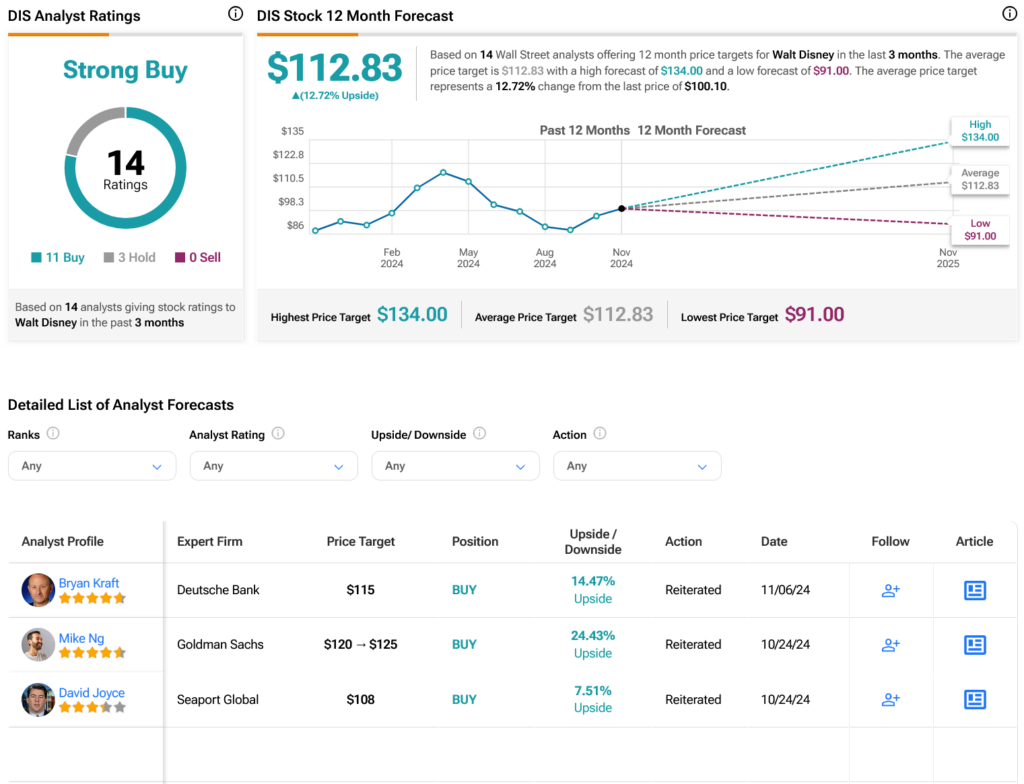

Turning to Wall Street, analysts have a Strong Buy consensus rating on DIS stock based on 11 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 13.21% rally in its share price over the past year, the average DIS price target of $112.47 per share implies 12.72% upside potential.