Entertainment giant Walt Disney (NYSE:DIS) will release its Q2 Fiscal 2024 financial results on Tuesday, May 7, 2024. Strong pricing and operating expense reductions will likely boost its top and bottom lines in Q2. Nevertheless, weak ad revenues in the linear networks and tough year-over-year comparisons in the Experiences segment could restrict the year-over-year growth rate.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

But before digging into analysts’ Q2 forecasts, it’s worth highlighting that Disney is prioritizing a business turnaround strategy. The company is engaged in discussions with potential content and marketing partners for ESPN. Also, it is focusing on offering a more unified streaming experience, aiming to increase engagement, reduce churn, and unlock greater advertising opportunities.

Thanks to its efforts, Disney stock is up about 26% year-to-date.

DIS – Q2 Expectations

Wall Street expects Disney to post revenue of $22.12 billion in Q2, up about 1% from $21.82 billion in the prior-year quarter. Disney expects revenue in its entertainment Direct-to-Consumer (DTC) business to grow sequentially, which will support its top line. Additionally, strength in Disney Parks and healthy advertising demand in the sports marketplace will likely drive its overall sales.

Improved sales and operation efficiency will cushion its bottom line. Analysts expect Disney to report earnings of $1.1 per share, up about 19% from $0.93 in the year-ago quarter.

Here’s What Website Traffic Shows

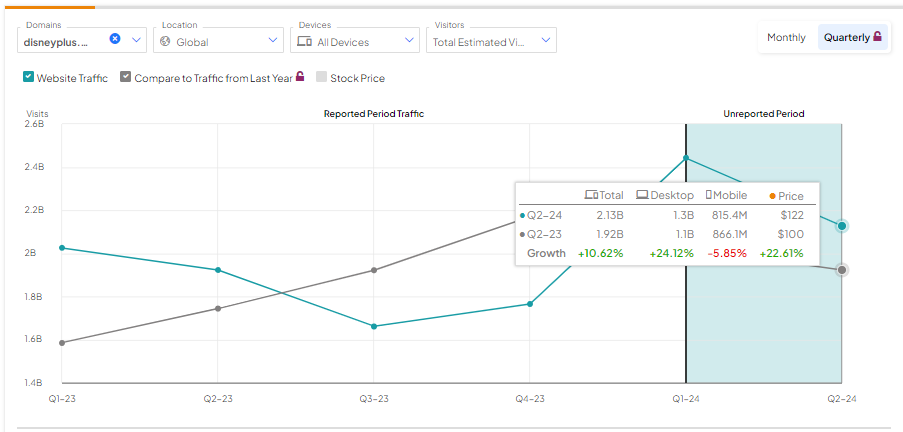

Disney is a leading streaming company. Thus, it is important to examine the company’s website traffic trend ahead of Q2 print.

TipRanks’ website traffic screener reveals that Disney’s traffic increased year-over-year in Q2. However, it decreased sequentially. According to the tool, the number of visits to disneyplus.com and its other websites increased by 10.62% year-over-year in Q2 but fell by about 12.88% sequentially.

Learn how Website Traffic can help you research your favorite stocks.

Is Disney a Buy, Sell, or Hold Stock?

Wall Street is bullish about Disney stock ahead of the Q2 earnings release. Disney shares have a Strong Buy consensus rating based on 24 Buys, three Holds, and one Sell. The analysts’ average price target on DIS stock of $128.93 implies a 13.43% upside potential.

Insights from Options Trading Activity

While analysts see decent upside potential in DIS stock, options traders are pricing in a +/- 6.43% move on earnings, smaller than the previous quarter’s earnings-related move of 11.5%.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Bottom Line

Disney is poised to deliver improved financial performance in Q2. However, website traffic trends show a sequential decline. Nonetheless, Wall Street is bullish about Disney’s prospects ahead of the second quarter earnings.