While entertainment giant Disney’s (DIS) plan to leave Major League Baseball (MLB) somewhat out of ESPN to a degree shook up the news this week, it also left the MLB itself a little shaken up. But Disney is surviving nicely, as investors sent shares up fractionally in Thursday afternoon’s trading.

Reports note that the MLB organization is reconsidering its entire rights and licensing structure in the wake of ESPN’s bid to opt out. The deal between ESPN and the MLB goes back around 35 years, and featured fully six games a week at its height. ESPN also showed Baseball Tonight, which managed to fill the gap on those rare occasions in summer when no live baseball game was in progress.

But now, with ESPN only showing 30 regular-season games in a year—most of which will happen as part of Sunday Night Baseball—the end result is the MLB needs to do something different. And the reason is pretty clear; ESPN paid $550 million annually for 30 games. Given that Apple TV (AAPL) is only spending $85 million for its Friday Night Baseball operation, ESPN’s objection to its price tag becomes clear. Thus, the MLB organization is reconsidering how it packages its games, and considering offering smaller, less-expensive packages to rebroadcast.

Look For the Union Button

But Disney has more problems than just baseball licensing to consider. Reports from the theme parks—already suffering under the weight of outrageous ticket prices and add-ons—suggest that the undercurrent of unionization is running through the park. Just ask several Disney workers who wore union buttons in full view of the public recently.

Not everyone who works at Disney is a Disney employee, or rather, cast member. For instance, at the Italy pavilion at EPCOT, the workers there are Patina Restaurant Group employees. And, as is commonly the case between businesses, the pay rates and benefits are often not the same, despite the fact that they may do much the same work. Thus, the buttons are out in a bid to call attention to the discrepancies and potentially win support.

Is Disney Stock a Buy or Hold?

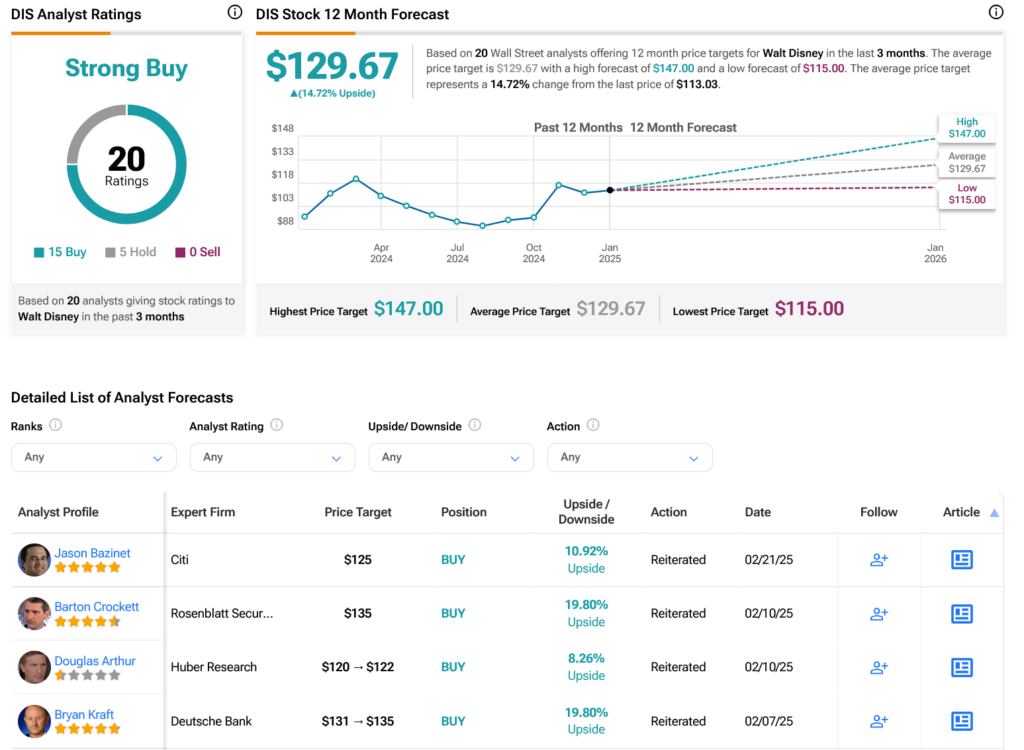

Turning to Wall Street, analysts have a Strong Buy consensus rating on DIS stock based on 15 Buys and five Holds assigned in the past three months, as indicated by the graphic below. After a 2.58% rally in its share price over the past year, the average DIS price target of $129.67 per share implies 14.72% upside potential.