This year, Nvidia (NVDA) stock has been a letdown for investors, mirroring the broader market pullback. So much so that the once glittering Wall Street darling, whom so many investors were calling overvalued, is now available with a sturdy discount. With the stock down by nearly 19% in the first five months of 2025, some might see this as a classic “buy the dip” opportunity. But it’s hard to ignore that rising macro risks and a slight slowdown in growth don’t mix well with a high-volatility stock that’s priced for perfection based on its amiable growth story.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

In the long term, the bullish thesis remains intact—Nvidia is well-positioned to ride the wave of secular AI trends. But in the short term, the stock trading below its long-term averages and losing momentum suggests this might not be the best time to buy or add to positions if you’re looking for quick gains.

For now, I’m taking a wait-and-see approach and sticking with a neutral stance on NVDA. However, I expect to shift towards a bullish stance later this year, with several ifs attached.

Nvidia Stock is Muted, But Don’t Bet Against It

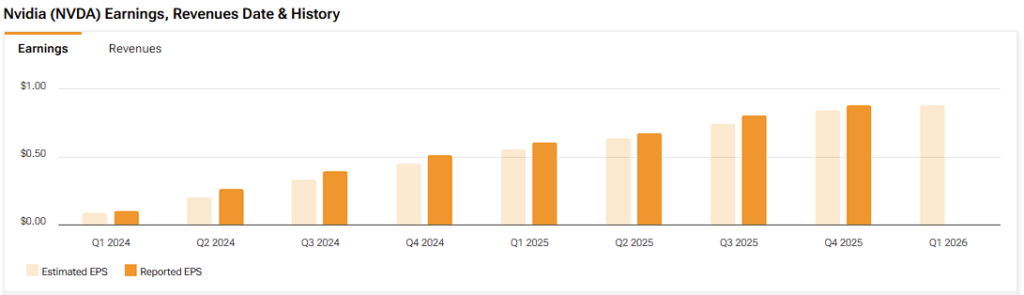

The buzz around Nvidia has cooled off in recent months, even though the company’s fundamentals haven’t given investors a good reason to back away. Sure, growth has slowed a bit, but a 12% revenue increase over the previous quarter is still substantial, especially in a shaky macro environment filled with uncertainty.

Data centers remain the backbone of Nvidia’s business, accounting for more than 90% of total sales. While some see that as a risk due to the company’s reliance on one revenue stream, its soaring market share in this space actually points to major growth potential, particularly for profits.

Margins have dipped slightly, but Nvidia still holds an impressive operating margin of around 62.4% over the last twelve months. That’s nearly double its five-year average and way above the industry average of just 5.8%.

Looking ahead, analysts expect Nvidia to grow its EPS by 35.2% annually over the next three to five years. Combine that with its 2025 forward price-to-earnings ratio of 25.7x, and you get a PEG ratio of just 0.2x, which is extremely low compared to its peers and historical figures. Since a PEG below 1x usually signals undervaluation, that could make Nvidia look like a steal right now.

Nvidia’s Growth Slowdown Makes Investors Think Twice

At least on paper, Nvidia might seem cheap, but that hinges on one key factor: its valuation only appears reasonable when adjusted for very high growth. And that, really, is the core of the bullish thesis around the stock.

But with U.S.-China tensions running hotter than ever, the threat of a full-blown trade war could seriously pressure Nvidia’s growth outlook. That’s a problem, especially since the company’s growth story is already showing signs of slowing, making analysts rethink their long-term forecasts.

In the past 30 days, revenue growth projections have been cut by 4% for 2029 and another 3% for 2030 and 2031, while EPS projections were trimmed by similar amounts. Sure, looking ahead four years can be quite subjective—but for a stock priced for perfection and needing to sustain a 30%+ CAGR to justify its “cheap” PEG, such revisions start to matter.

When to Buy Nvidia

After breaking down the pros and cons of owning Nvidia, more cautious investors might ask themselves: Should I wait for a bigger pullback or just buy and hold, even if that means dealing with some short-term pain from volatility?

To help navigate that, I think a solid approach would be to keep an eye on two things: (1) the share price in relation to key moving averages and (2) the 14-day standard deviation (volatility).

Given Nvidia’s strong fundamentals and arguably cheap valuation, once growth is factored in, it makes sense to own the stock most of the time. But there are exceptions—like when the share price dips below the 200-day moving average or when the 14-day annualized volatility spikes above 70%, placing it in the top 10% of Nvidia’s historical volatility levels.

Why does that matter? Well, Nvidia’s annualized volatility is high, currently around 59%. So, leaning on long-term moving averages like the 200-day line helps cut through the noise and avoids being whipsawed by short-term price swings. When volatility surges past a threshold like 70%, it’s often a red flag that the market’s getting jittery, which could be a smart time to reduce exposure or sit on the sidelines.

In fact, over the last 10 years, using this strategy would have delivered a 62.8% compound annual return, just slightly below the buy-and-hold approach, which returned around 69%, but with 1.2% less volatility. On the other hand, doing the opposite—buying when the stock was above the 200-day average and volatility was spiking—would’ve only earned you about 18.8% annually.

So, where do we stand now? Nvidia’s 200-day simple moving average is around $125, but the stock is currently trading below that at $113. Meanwhile, the 14-day volatility is sitting at a relatively calm 53%. This framework suggests that now might not be the ideal time to buy.

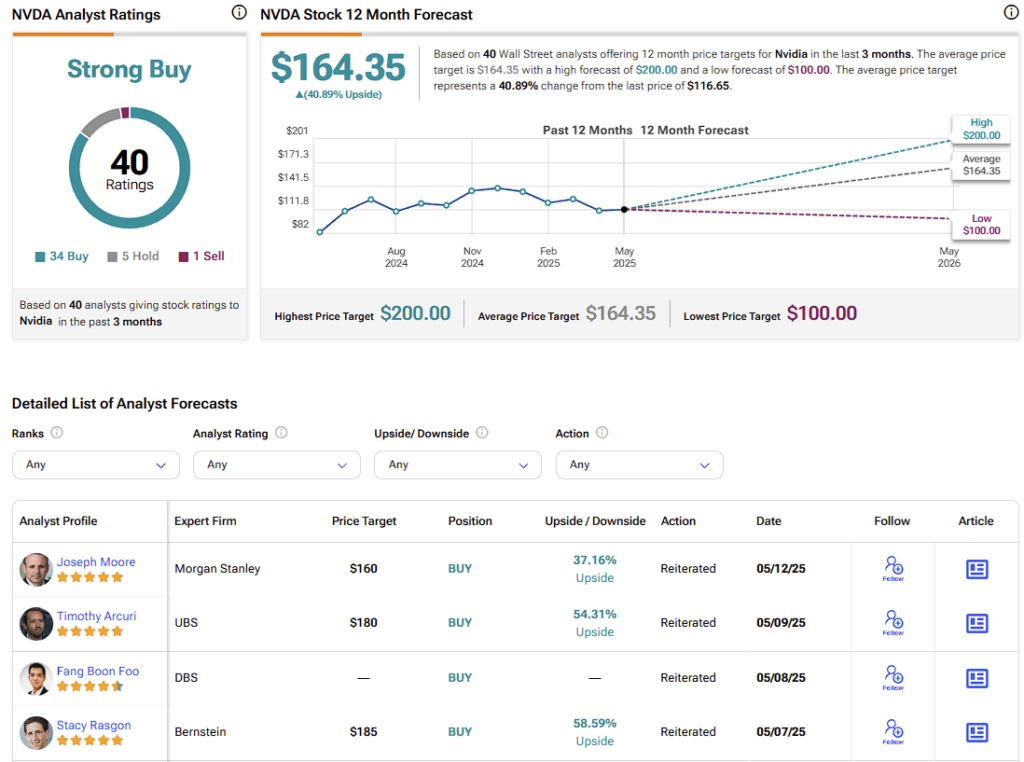

What is the Prediction for NVDA Stock?

Most Wall Street analysts covering Nvidia stock are stoutly confident that now is a good time to buy. Over the past three months, 34 out of 40 analysts have rated NVDA as a Buy, with five staying neutral and just one leaning bearish. NVDA’s average price target is $164.35, which suggests more than 40% upside over the coming year from where the stock is currently trading.

NVDA Stock is for Holding, Not Flipping

Nvidia’s weak momentum in 2025 shows that macro risks, combined with a natural slowdown in its growth story, don’t mix well for a stock that only looks attractive when adjusted for aggressive growth.

I don’t doubt Nvidia will continue delivering solid long-term results, and at its current multiples, it still makes sense as a long-term hold. However, given the current price action, this may not be the right moment for investors looking for shorter-term gains. That’s why I’m staying on the sidelines for now and taking a neutral stance on NVDA.