Walt Disney’s (DIS) stock skyrocketed 10.25% in pre-market trading following an impressive fourth-quarter report for Fiscal 2024. The company reported earnings per share (EPS) of $0.25, which comfortably surpassed analysts’ consensus of $1.11. The quarterly revenue of $22.6 billion exceeded the forecasted $22.49 billion, marking a 6% year-over-year increase. This robust performance signals that Disney is emerging strong from recent challenges, positioning itself well for future growth.

Disney’s EPS Surpasses Consensus

Disney’s performance in Q4 was particularly strong in terms of earnings. The company posted a notable 79% year-over-year increase in EPS for the quarter, reaching $0.25, compared to $0.14 in Q4 2023. Full-year EPS also more than doubled, jumping to $2.72 from $1.29 in the previous year. The company’s ability to deliver solid profits despite market turbulence reflects the strength of its diversified business model and strategic investments in content and innovation.

Disney’s Entertainment and Streaming Drive Growth

Revenue growth was largely driven by gains in Disney’s entertainment and streaming segments. For Q4, the company reported a 23% growth in total segment operating income, with a significant contribution from Disney’s Direct-to-Consumer (DTC) services, including Disney+ and Hulu. Disney+ saw a 14% rise in ad revenue, adding to the streaming division’s operating income of $321 million for the quarter. Additionally, box office hits like Inside Out 2 and Deadpool 3 helped boost content sales, adding $316 million to operating income.

The company ended Q4 with a total of 174 million Disney+ Core and Hulu subscriptions, which includes more than 120 million paid Disney+ Core subscribers—a 4.4 million increase from the previous quarter. These results suggest strong momentum in Disney’s streaming business, which has been a crucial growth driver in recent years.

Disney Expects Positive Growth for 2025

Looking ahead, Disney remains optimistic about its long-term growth. The company expects high-single-digit adjusted EPS growth for Fiscal 2025 compared to Fiscal 2024, forecasting adjusted EPS between $3.02 to $3.15, up from $2.72 in 2024. The company also expects approximately $15 billion in cash from operations, with capital expenditures of around $8 billion.

For Fiscal 2026, Disney projects double-digit growth in adjusted EPS and cash flows, with segment operating income in Entertainment expected to grow by a double-digit percentage. The company also targets a 6% to 8% increase in operating income for its Experiences segment, with the second half of the year expected to be stronger.

Is Disney a Buy, Sell or Hold?

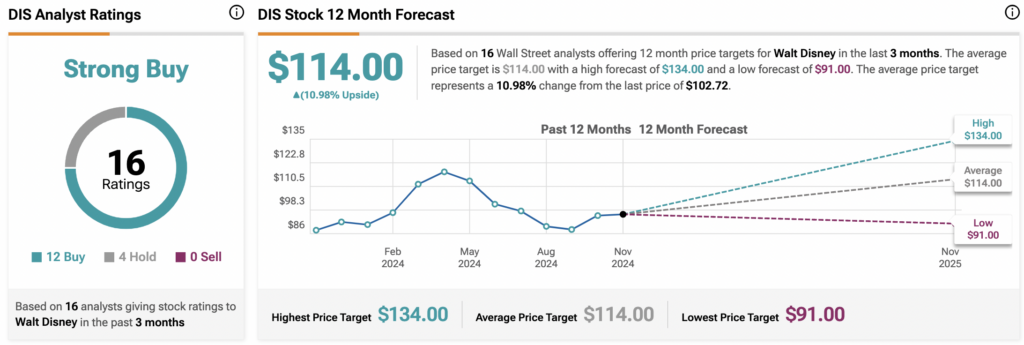

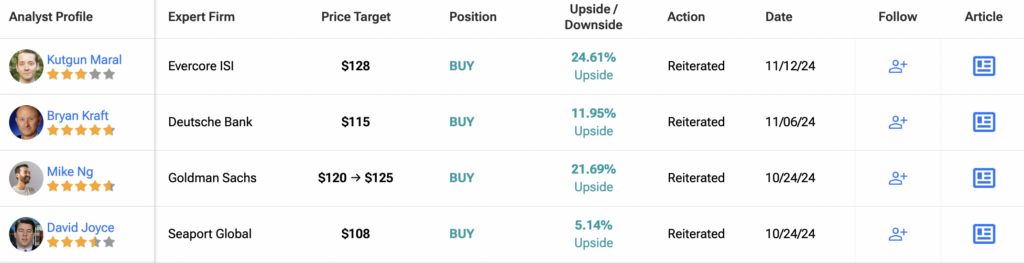

Analysts remain bullish about DIS stock, with a Strong Buy consensus rating based on 12 Buys and four Holds. Year-to-date, DIS stock has increased by more than 10%, and the average DIS price target of $114 implies an upside potential of 11% from current levels.