Tech stocks, especially those with a focus on AI, have been the darlings of Wall Street for some time now. However, one investing legend seems to be stepping back from the frenzy.

Warren Buffett, famously known for his substantial Apple (NASDAQ:AAPL) holdings, significantly reduced his AAPL position in Q2, selling off approximately 390 million shares. This move means he has offloaded more than half of his stake in the first half of 2024.

Apple wasn’t the only tech company to feel the pinch. In Q2, Buffett also exited his entire position in Snowflake (NYSE:SNOW), offloading around 6 million shares valued at nearly $989 million.

But for every seller, there must be a buyer, and it seems another billionaire has been willing to pick up whatever Buffett no longer desires. Steve Cohen’s asset management firm Point72 has plans of launching a distinct AI-focused fund early next year, and in the meantime the billionaire investor has been snapping up shares of AAPL and SNOW, both of which are making significant strides in the AI space.

With all that as a backdrop, let’s take a closer look at the two firms and see why these legendary investors appear to be taking contrasting views of their prospects. With some assistance from the TipRanks database, we can also see which side Wall Street’s cadre of analysts currently favors.

Apple

After a period conceding its standing as the world’s most valuable company, Apple has reclaimed its crown, and is once again top of the pile. The tech giant had lost some ground to long-time rival Microsoft (and briefly to Nvidia) with both companies riding the AI boom.

Apple losing its top dog status came at a time of depressed sentiment around the tech giant. There were concerns around iPhone demand, especially in the key China market. However, the recent FQ3 results (June quarter) suggest the company is back on course; while iPhone sales did decline, the drop was much less severe, and other segments of the business contributed to Apple surpassing both revenue and profit expectations.

Meanwhile, moving forward, Apple also appears ready to address another issue that had been niggling investors. While its peers had been making the most of the AI opportunity, Apple was absent from proceedings. But having now launched Apple Intelligence and readying for the release of its latest iteration of the iPhone next month, the company is finally grabbing the AI bull by the horns.

Steve Cohen must think there’s a sizable opportunity here; during Q2 he opened a new position in AAPL by purchasing 1,573,924 shares. These currently command a market value of $357 million.

Apple also has a big fan in Wedbush analyst Daniel Ives, who thinks there’s a growing realization the company will have a meaningful role to play in this new paradigm.

“We believe the Street is starting to slowly recognize that with Apple Intelligence on the doorstep in essence Cupertino will be the gatekeepers of the consumer AI Revolution,” Ives explained. “Developers and other technology stalwarts will likely now need to integrate their AI models/technology into Apple Intelligence looking ahead as Apple and its golden iOS ecosystem hold the only keys to the castle of 2.2 billion iOS devices worldwide and 1.5 billion iPhones.”

“We believe AI technology being introduced into the Apple ecosystem will bring monetization opportunities on both the services as well as iPhone/hardware front and adds $30 to $40 per share,” Ives went on to add.

Reflecting his confidence, Ives rates Apple shares as Outperform (i.e., Buy), with a Street-high price target of $285, suggesting the stock could surge 26% over the next 12 months. (To watch Ives’ track record, click here)

Most analysts on the Street share this optimism. Apple stock holds a Moderate Buy consensus rating, based on 24 Buy recommendations, 8 Holds, and 1 Sell. The average price target stands at $247.43, representing a potential one-year upside of 9%. (See Apple stock forecast)

Snowflake

Tech might be the driving force behind the current bull market, but Snowflake has been excluded from the party. The shares have retreated by 34% since the turn of the year, despite the company being considered a potential AI beneficiary.

Snowflake offers a cloud-based data warehousing platform that enables organizations to store, manage, and analyze vast amounts of data efficiently. Unlike traditional data warehouses, the platform separates compute and storage, allowing for scalable and flexible data processing. Snowflake is known for its ease of use, offering a SQL-based interface that works across different cloud providers, including AWS, Azure, and Google Cloud.

The company has also been actively expanding its AI capabilities. By integrating machine learning and AI tools directly into its platform, it enables users to build, train, and deploy models without moving data outside the platform.

With all that you would think the stock would be a highflyer but that has not been the case. Disappointing earnings have dulled sentiment while the company is heavily investing in developing AI features. That has driven up costs due to elevated GPU expenses for these initiatives and the expected revenue gains from these investments have yet to materialize.

Nonetheless, Steve Cohen appears to be betting on a turnaround. In Q2, he initiated a new position by purchasing 533,623 SNOW shares, now valued at over $70.1 million.

Meanwhile, Snowflake has been in the news recently for other reasons. A recent data breach resulted in customer accounts being compromised. However, after checking in with some big clients, Scotiabank Patrick Colville thinks that overall, the company’s prospects are sound.

“There is a lot going on at Snowflake: customer data breaches, fears of competitive pressures, a CEO re-shuffle, changes brought on by open table formats,” Colville explained. “But we come away from 6 checks with very large customers with the view that spending on Snowflake will be better than the consensus anticipates. We expect little to no impact on Snowflake as a result of the recent credential theft incident. Customers continue to view Snowflake as the best cloud data warehouse, and our checks marginally up-ticked on Snowflake as an AI beneficiary.”

To this end, Colville has an Outperform (i.e. Buy) rating on SNOW shares, backed by a $195 price target. The implication for investors? Upside of ~48% from current levels. (To watch Colville’s track record, click here)

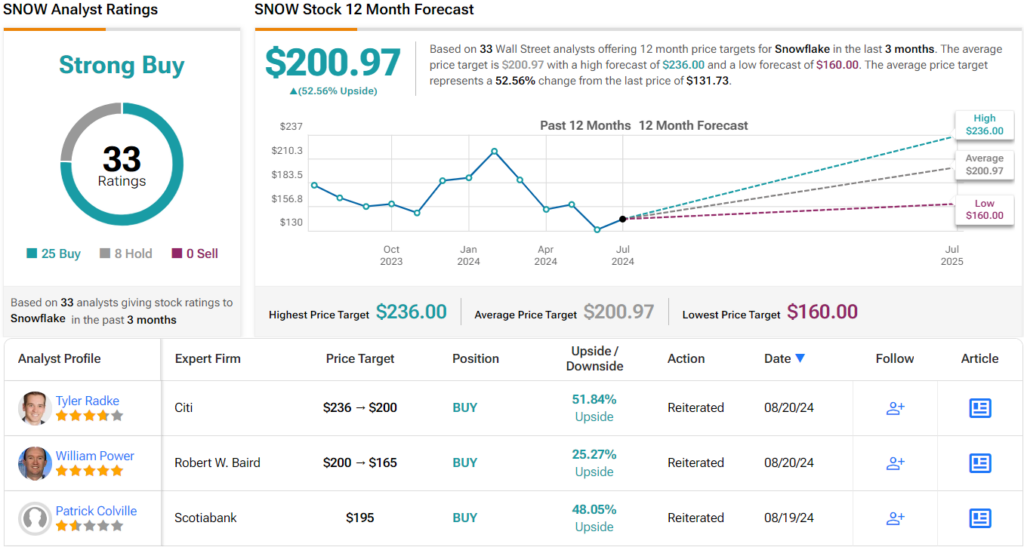

Colville gets the backing of most of his colleagues here. With an additional 24 Buys and 8 Holds, the stock receives a Strong Buy consensus rating. The average price target is a touch higher than Colville will allow; at $200.97, the figure implies shares will climb ~53% higher in the months ahead. (See Snowflake stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.