Medical device maker DexCom (DXCM) operates in a highly competitive market for continuous glucose monitoring (CGM) systems, with players competing fiercely on features, price, accessibility, and the potential for repeat purchases. At the same time, DexCom is facing a class action lawsuit accusing the company of misleading investors by making tall claims about revenue expectations for Fiscal 2024 and not living up to them. Nonetheless, DXCM stock continues to score a Strong Buy consensus rating from Wall Street analysts.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Despite the competition, DexCom has been able to outpace earnings expectations in all of the past eight consecutive quarters. However, while reporting its second-quarter Fiscal 2024 results, the company slashed its full-year Fiscal 2024 revenue guidance, citing failure to execute certain strategies effectively.

Insights from TipRanks’ Bulls Say, Bears Say Tool

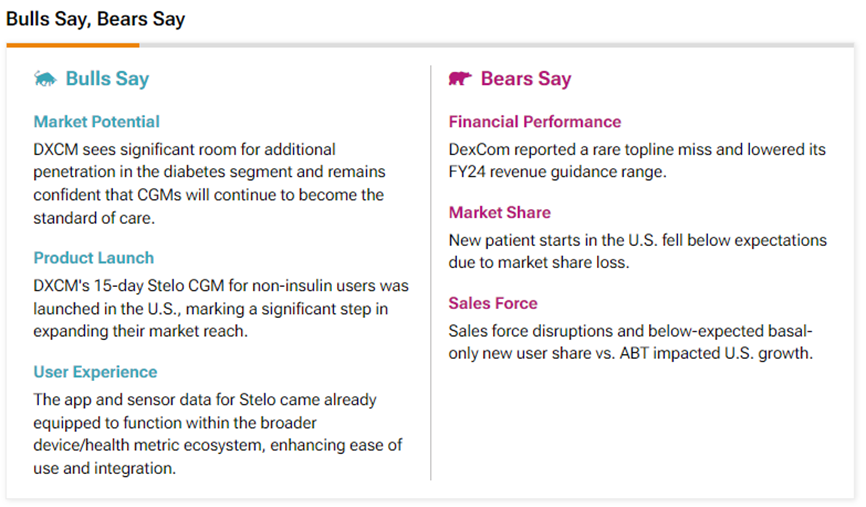

Amid a competitive backdrop, DexCom draws attention from both Bulls and Bears. According to TipRanks’ Bulls Say, Bears Say tool, some analysts are optimistic about the company’s ability to further penetrate the diabetes market with its CGM products. Analysts are especially excited about the future potential of DexCom’s Stelo CGM device.

On the other hand, bears are concerned about the rare Q2 revenue miss and the FY24 guidance cut. Also, they noted the lower-than-expected new patient starts in the U.S. and declining market share, with rivals such as Abbott (ABT) impacting the domestic business.

Hedge Funds and Retail Investors Give Conflicting Signals

Based on TipRanks’ data, hedge funds have a Very Negative Confidence Signal on DXCM stock, as several hedge funds have decreased their holdings by 687,900 DexCom shares in the last quarter.

On the contrary, retail investors favor DXCM stock, according to TipRanks’ Stock Investors tool. The number of retail portfolios (of investors using TipRanks’ Smart Portfolio) holding DXCM stock increased by 4.1% in the last 30 days.

Is DexCom Stock a Good Buy?

Surprisingly, a higher number of analysts remain optimistic about DexCom stock. On TipRanks, DXCM stock has a Strong Buy consensus rating based on 12 Buys versus four Hold ratings. Also, the average DexCom price target of $96.81 implies 41.1% upside potential from current levels. Meanwhile, DXCM shares have declined 44.7% so far this year.