Tesla (NASDAQ:TSLA) could face both opportunities and challenges under Trump’s presidency. On the one hand, Elon Musk’s upcoming role in the new administration – heading up the ‘efficiency’ department – could offer Tesla certain advantages.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

However, Trump’s well-known skepticism toward electric vehicles presents potential headwinds for the industry, as his administration is likely to repeal EV tax incentives and rebates, which could impact Tesla and its competitors alike.

Looking at the positives, Deutsche Bank analyst Edison Yu believes Trump’s win might still prove advantageous for the many pies Musk has his fingers in.

“Beyond attributing the price action to tactical factors (e.g., retail exuberance, algos, short covering due to lack of near-term negative catalysts, etc.), we see potential large terminal value benefits to Tesla’s efforts in auto, robotaxi, and even humanoid robotics,” Yu explained.

So, how will this actually unfold under a Trump administration? Well, there could be favorable policies for Tesla. On robotaxis, currently, regulations vary by state, with some having little to no clear guidelines. Yu could see the new administration “setting standards at the national level to make approval of deployment faster/simple.”

Additionally, if the IRA is repealed or amended, or if additional tariffs are imposed on imported parts, Yu expects Tesla’s relative competitive position to improve. Tesla already boasts the highest U.S. content of any major model sold in the country, and its scale and cost structure for BEVs is “far ahead of competitors.” In fact, both GM and Ford are anticipating significant benefits from the IRA in the coming years, which are crucial for improving their EV profitability.

Furthermore, there’s the possibility of federal support for humanoid robotics. Developing a supply chain capable of large-scale, low-cost production is key to industrializing humanoid robots. “We could envision policy support similar to that given to the semiconductor industry where grants or loans are handed out for building out infrastructure,” Yu said on the matter.

Perhaps the most significant uncertainty lies with China but Musk is a “very popular” there, and Tesla is the only foreign automaker with a significant presence in China’s EV market. “Could his influence facilitate some type of win-win reconciliation?” asks Yu.

Time will tell. For now, Yu rates Tesla shares a Buy. (To watch Yu’s track record, click here)

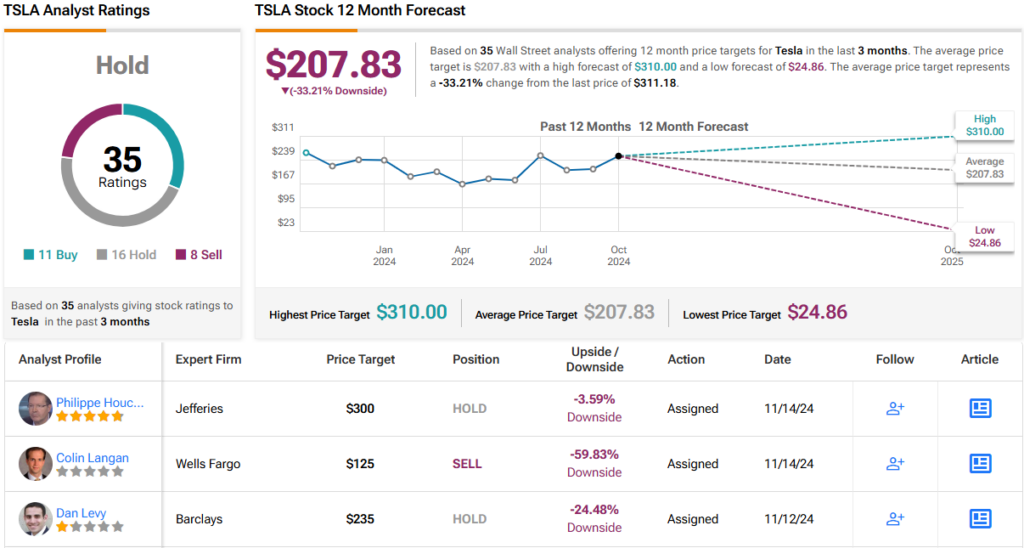

10 other analysts remain TSLA bulls but there are 16 skeptics showing Hold ratings and 8 bears imploring to Sell, all adding up to a Hold (i.e. Neutral) consensus rating. Meanwhile, the $207.83 average price target factors in a 12-month drop of 33%. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.