Delta Airlines (NYSE:DAL) declined in pre-market trading after announcing its calendar Q4 and FY23 results. The airline’s FY24 earnings outlook was less than its prior forecast. The company expects adjusted earnings in the range of $6 to $7 per share in FY24. This was below earnings of more than $7 per share predicted by Delta last year. The airline expects revenue in the first quarter of 2024 to increase between 3% and 6% year-over-year. In addition, it has forecasted March quarter earnings between $0.25 and $0.50 per share, in line with analysts’ estimates.

Delta reported adjusted earnings of $1.28 per share in the December quarter, above analysts’ estimates of $1.17 per share. The airline generated operating revenues of $13.7 billion, up by 11% year-over-year, surpassing consensus estimates of $13.5 billion.

In FY23, Delta delivered operating revenues of $54.7 billion, an increase of 20% year-over-year, with Premium and non-ticket revenue comprising 55% of total revenue. Moreover, Delta reinstated its quarterly dividend, generated $2 billion in free cash flow for the year, and repaid $4.1 billion of its gross debt.

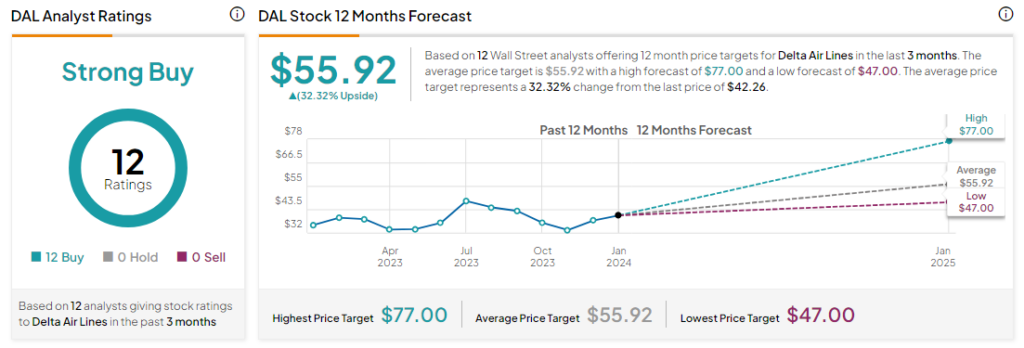

Is DAL a Buy or Sell?

Analysts remain bullish about DAL stock with a Strong Buy consensus rating based on 12 Buys. Over the past year, DAL stock has gone up by more than 5%, and the average DAL price target of $55.92 implies an upside potential of 32.3% at current levels.