Shares of industrial machinery manufacturer Deere (DE) are up/down in today’s trading as investors await its Q4 earnings results on November 21 before the market opens. Analysts are expecting earnings per share to come in at $3.87 on revenue of $9.22 billion. This represents a decline from the $8.26 per share on revenue of $15.41 billion seen in the year-ago period, according to TipRanks’ data.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

However, it seems likely that the firm will beat earnings estimates, as it has done so for eight consecutive quarters. Still, these beats have never been big enough to suggest that Deere will be able to exceed last year’s figure.

In addition, it is worth noting that the agriculture industry has been in a decline during the past year. According to TipRanks’ Bulls Say, Bears Say tool, overall Agriculture & Turf sales fell by 22.3% year-over-year. This has led to a higher inventory level, as the number of HHP tractors and combines on hand are 40% and 30% above their five-year averages, respectively.

What Do Options Traders Anticipate?

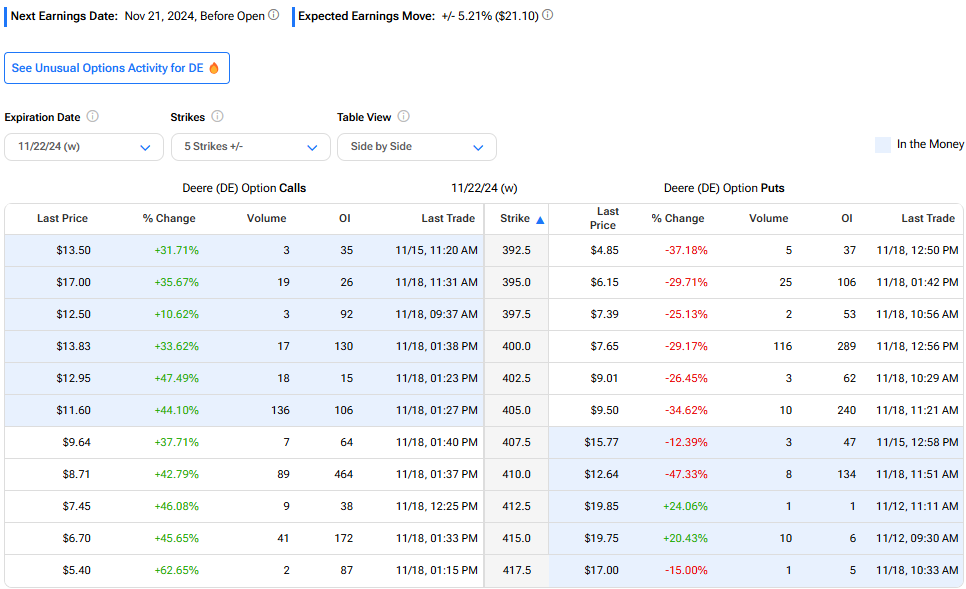

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. Indeed, the at-the-money straddle suggests that options traders expect a 5.21%, or $21.10, price move in either direction. This estimate is derived from the $405 strike price, with call options priced at $11.60 and put options at $9.50.

Is DE Stock a Buy?

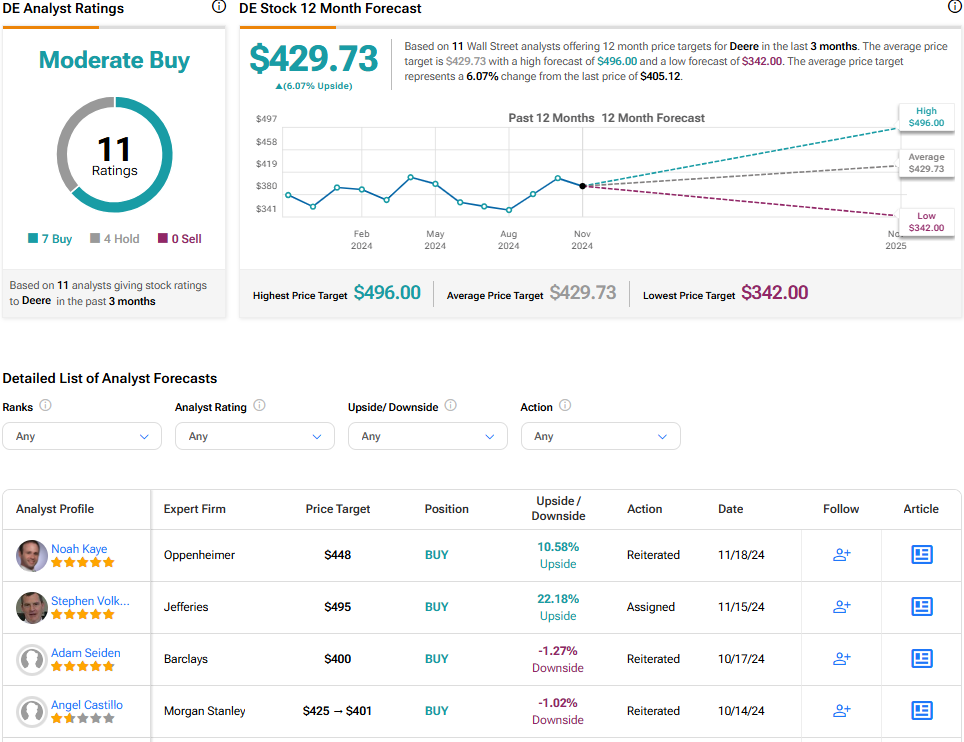

Turning to Wall Street, analysts have a Moderate Buy consensus rating on DE stock based on seven Buys, four Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After an 8% rally in its share price over the past year, the average DE price target of $429.73 per share implies 6.1% upside potential.

Interestingly, it seems like money managers agree with the Buy rating. Indeed, hedge funds increased their holdings in DE stock by 221,000 shares in the past quarter. As a result, TipRanks’ hedge fund confidence signal is currently very positive on the stock.