Deere & Co. (DE), the maker of John Deere tractors and farm equipment, has announced more layoffs due to a persistent slump in the U.S. agriculture sector.

The company said it is laying off an additional 300 people at its manufacturing facilities in Iowa and Illinois as demand for farm equipment declines. It’s the latest in a series of layoffs at Deere & Co. Since September 2023, more than 1,600 employees have been laid off from plants in the U.S. Midwest as the company moves more of its manufacturing to Mexico.

Management at the company has said they are struggling with falling agriculture prices. Corn prices have declined more than 20% over the last 12 months, while soybean prices have decreased more than 10%. Lower crop prices mean less revenue for farmers and less money for machinery purchases such as tractors and hay balers.

Shifting Production to Mexico

Owing to the difficult situation in the U.S. heartland, Deere & Co., which is the world’s biggest agriculture machinery manufacturer, has lowered its earnings outlook for the remainder of this year. At the same time, shifting more production to Mexico has drawn political fire from U.S. presidential candidate Donald Trump, who has threatened slap tariffs on the company.

Management said the latest round of layoffs are due to reduced demand for the products it makes at its Midwestern facilities. The company said about 200 production workers will be let go in East Moline, Illinois, 80 workers in Davenport, Iowa, and about seven people in Moline, Illinois. DE stock has risen 4% so far in 2024.

Is DE Stock a Buy?

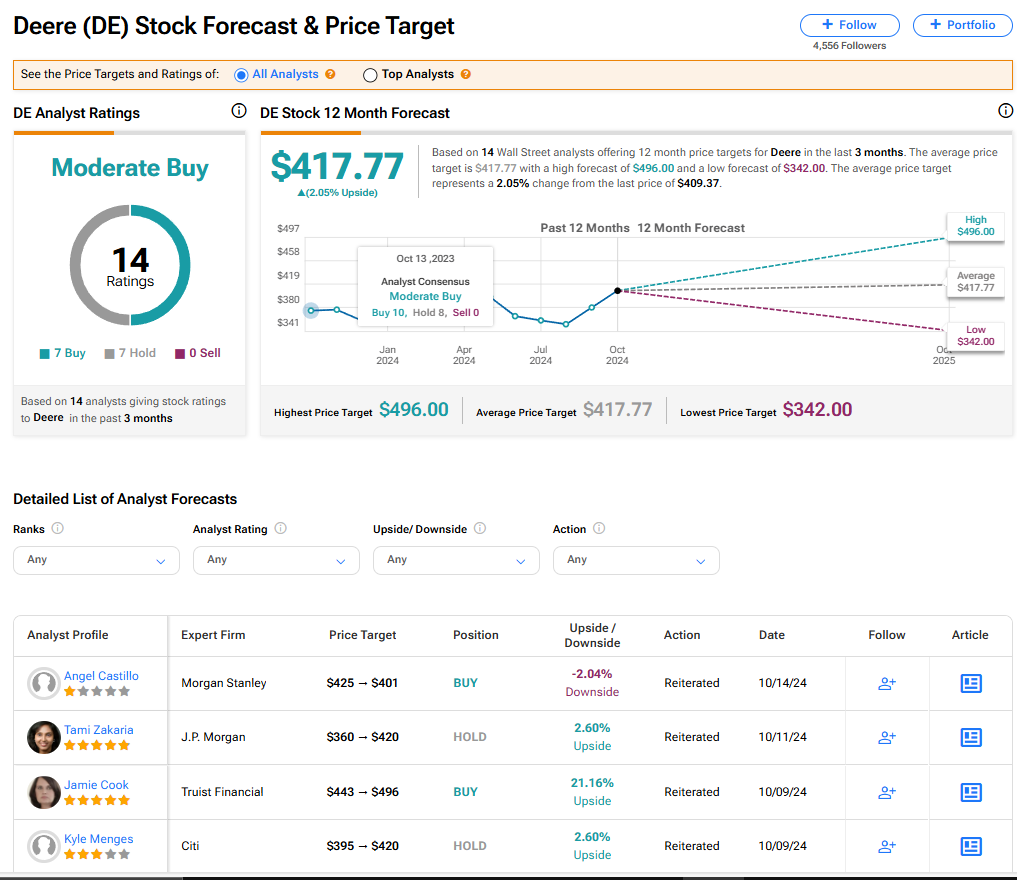

Deere & Co. stock has a Moderate Buy rating among 14 Wall Street analysts. That rating is based on seven Buy and seven Hold recommendations assigned in the last three months. There are no Sell ratings on the stock. The average DE price target of $417.77 implies 2.05% upside from current levels.