It’s being called the “X-odus,” and it could be good news for Meta Platforms (META).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Following the recent U.S. election, as many as 60,000 people a day have deactivated their accounts on social media site X, formerly Twitter, which is run by Elon Musk. People who have left the platform range from celebrities such as actress Jamie Lee Curtis and author Stephen King to working professionals and students.

People fleeing X say they are doing so because the site has become too political, is loaded with misinformation, and is too toxic. While the decline in daily users is no doubt a negative for X, it could end-up benefitting Meta Platforms, which runs the competing social media platform Threads.

“Follow me on Threads, if you like,” wrote Stephen King in announcing his departure from X.

Microsoft Could Benefit Too

X-it, as the mass account deactivation is also being called, is seen as a potential boon to Meta Platforms, which launched the competing Threads social media platform in summer 2023. Threads came out of the gate strong, racking up more than 100 million users five days after its debut. At one point, Threads was growing at a faster clip than artificial intelligence (AI) sensation ChatGPT.

While Threads growth has since slowed, the platform today claims to have more than 200 million monthly active users. Other destinations where former X users appear to be congregating include LinkedIn, which is owned by Microsoft (MSFT), and Bluesky, a microblogging social networking site that was created by a former Twitter employee.

So far, Meta Platforms, Microsoft, and Bluesky haven’t said what impact the X-odus has had on their social media platforms.

Is META Stock a Buy?

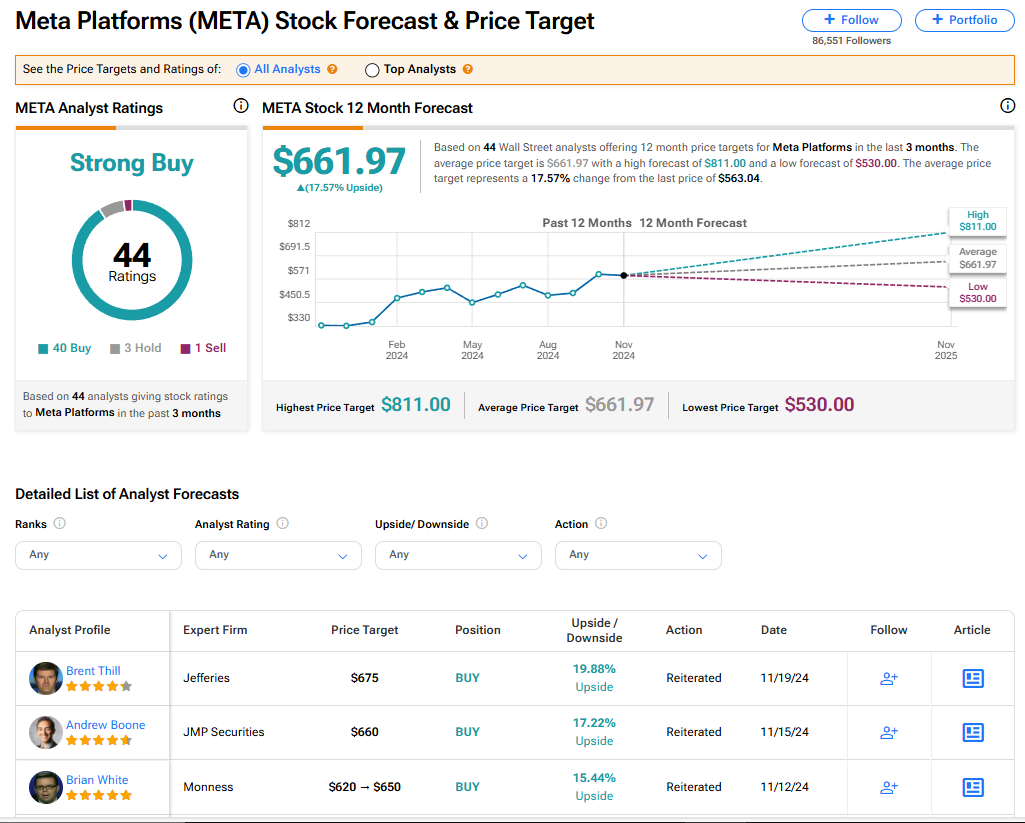

Meta Platforms stock has a consensus Strong Buy rating among 44 Wall Street analysts. That rating is based on 40 Buy, three Hold, and one Sell recommendations made in the last three months. The average META price target of $661.97 implies 17.57% upside from current levels.