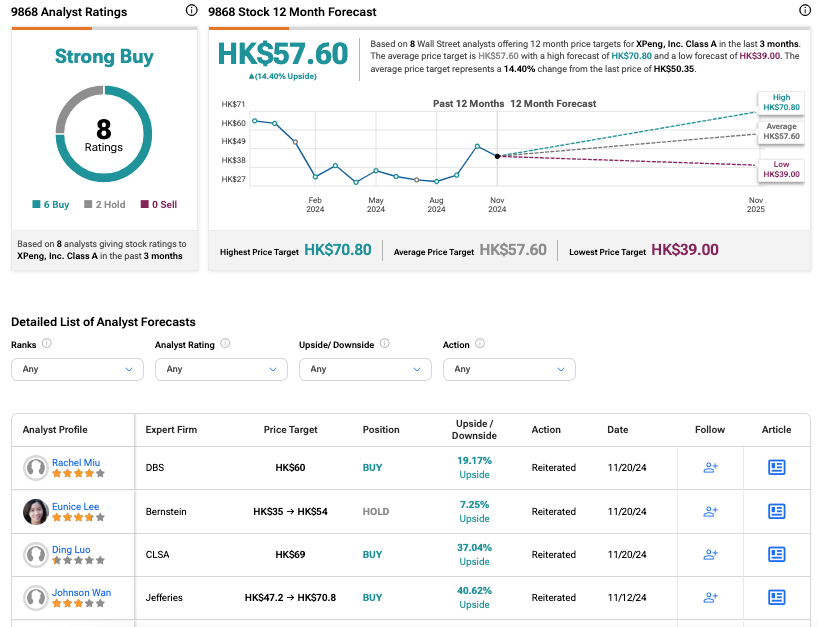

Hong Kong-listed XPeng, Inc. (HK:9868) has earned bullish reviews from a DBS analyst following the release of the electric vehicle (EV) maker’s strong Q3 results. Notably, analyst Rachel Miu from DBS predicts 20% upside potential in XPeng stock while maintaining a Buy recommendation. Overall, XPeng has received a Strong Buy rating from analysts.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Based in China, XPeng specializes in the manufacturing and sales of smart EVs.

XPeng Delivers Strong Q3 Performance

In Q3, XPeng delivered a total of 46,533 vehicles, marking 16.3% year-over-year growth. Meanwhile, total revenues increased 18.4%. XPeng’s net loss attributable to ordinary shareholders reduced to ¥1.81 billion in Q3, reflecting a significant improvement from the ¥3.89 billion loss a year ago.

In terms of outlook, XPeng expects a 44.6% to 51.3% surge in vehicle deliveries, projecting between 87,000 and 91,000 units for the fourth quarter.

DBS Maintains an Optimistic Stance

Miu praised XPeng’s strong sales growth and stated that it was fueled by the successful debut of the MONA M03 model. The analyst believes XPeng’s market prospects are bright, driven by strong pre-sale orders for MONA M03 during the National Day Golden Week and expected sales growth.

Moreover, Miu further highlighted the company’s strategic move away from LiDAR technologies in favour of cost-effective alternatives. XPeng’s strategic shift is exemplified by the launch of the P7+, featuring an AI-powered advanced driver assistance system that eliminates the need for LiDAR. This move is further expected to boost the company’s autonomous driving capabilities in a competitive environment.

Additionally, CLSA analyst Ding Luo reaffirmed a Buy rating on XPeng stock following its Q3 results. Luo expects a substantial 37% increase in the share price. Meanwhile, Bernstein maintained its Hold rating on the stock while raising its price target from HK$35 to HK$54.

Is XPeng a Good Stock to Buy?

On TipRanks, 9868 stock has received a Strong Buy rating from analysts, based on six Buy and two Hold recommendations. The average XPeng share price forecast is HK$57.60, which implies an upside of 14.4% from the current level.