Shares of Danaher Corporation (DHR) jumped over 9% on July 21 after the company delivered better-than-expected second-quarter results.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Danaher Corp is a globally diversified conglomerate that engages in the manufacturing, designing, and marketing of medical, industrial, and commercial products and services.

A Snapshot of Danaher’s Q2 Results

The company reported stellar quarterly earnings of $2.76 per share, higher than analysts’ estimates of $2.35 per share. Danaher had posted earnings of $2.46 per share in the same quarter last year.

Meanwhile, revenue climbed 7.5% year-over-year to $7.8 billion and surpassed the Street’s estimate of $7.32 billion. The revenue growth is attributed to adjusted core revenue growth of 9.5%.

The company has reiterated its financial guidance for FY2022 and expects adjusted core revenue growth to be in the high-single-digit range.

The CEO of Danaher Corporation, Rainer M. Blair, said, “We believe the combination of our strong portfolio and talented team—all powered by the Danaher Business System—provides a strong foundation in today’s dynamic operating environment and positions us well for the balance of 2022 and beyond.”

Wall Street Is Bullish on Danaher

Following the results, RBC Capital analyst Deane Dray increased the price target on Danaher to $317 (13.5% upside potential) from $301 and reiterated a Buy rating on the stock.

Similarly, Luke Sergott of Barclays hiked his price target on Danaher to $310 (11.02% upside) from $290 while reiterating a Buy rating.

Further, Cowen analyst Dan Brennan reiterated a Buy rating on the stock with a price target of $343 (22.8% upside potential).

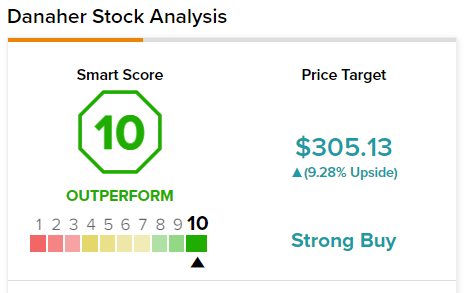

Overall, the stock has a Strong Buy consensus rating based on nine Buys and two Holds. Danaher’s average price forecast of $314.20 implies 14.14% upside potential from current levels.

DHR scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform the market.

Concluding Thoughts

Danaher has impressed with its solid quarterly beat and continuing gains in market share. Investors remain confident in the underlying growth story.

Read full Disclosure