Delta Airlines (NYSE:DAL) jumped in pre-market trading after announcing record revenues in the first quarter. The airline generated record operating revenues of $13.7 billion in Q1, up by 8% year-over-year and well above Street estimates of $12.5 billion.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The revenue growth was spurred by strong travel demand, especially corporate travel sales, which increased by 14% year-over-year.

DAL reported adjusted earnings of $0.45 per share, marking an 80% year-over-year increase and surpassing consensus estimates of $0.35 per share.

Moreover, the company repaid $1 billion of debt in the first quarter and at the end of Q1, its leverage ratio was 2.9 times (2.9x). The leverage ratio measures the ability of a company to fulfill its financial obligations.

Looking forward to the June quarter, the company expects its revenues to grow from 5% to 7% year-over-year while earnings are likely between $2.20 and $2.50 per share. In FY24, DAL has projected earnings to range from $6 to $7 per share, and free cash flow is forecasted to be between $3 billion and $4 billion.

What is the Future of DAL Stock?

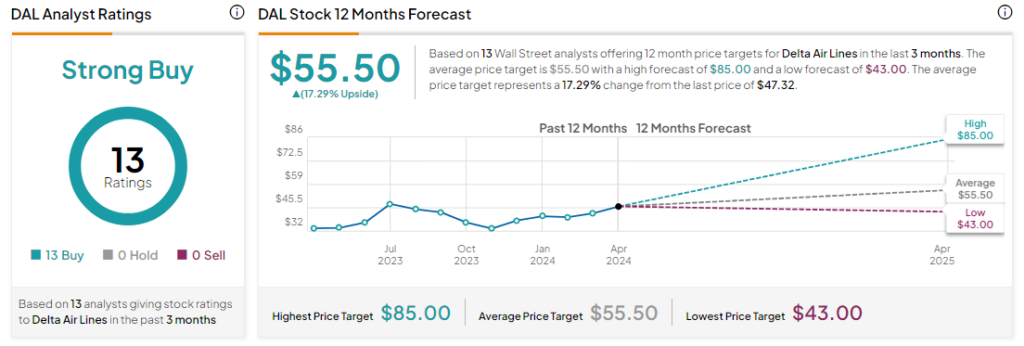

Analysts are bullish about DAL stock, with a Strong Buy consensus rating based on a unanimous 13 Buys. Year-to-date, DAL has soared by more than 15%, and the average DAL price target of $55.50 implies an upside potential of 17.3% from current levels. However, these analyst ratings are likely to change following DAL’s Q1 results today.