Daimler AG has agreed to pay $2.2 billion to settle a class action battle in the US over allegations that the German carmaker installed software in diesel vehicles to evade emissions regulations.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Daimler (DDAIF) said that for the settlements with US authorities, it expects costs of about $1.5 billion including civil penalties as well as expected costs for mitigation and the implementation of the Emission Modification Program. The estimated cost of the class action settlement amounts to about $700 million including the court’s anticipated award of attorneys’ fees and costs. Daimler expects additional expenses of a mid-three-digit-million EUR amount to fulfill requirements of the settlements, the company said.

“By concluding the proceedings, Daimler avoids lengthy court actions with respective legal and financial risks,” Daimler said in a statement. “Daimler denies the material factual allegations and legal claims asserted by the plaintiffs and settlement class members.”

The civil proceedings are tied to emission control systems of about 250,000 of Daimler’s diesel vehicles in the US. More specifically, the settlement relates to MY 09-16 Mercedes-Benz diesel passenger cars and diesel-powered MY 10-16 Mercedes-Benz and Freightliner Sprinters with BlueTEC II emission control systems sold or leased in the US.

Daimler will pay a civil penalty totaling $875 million out of the $1.5 billion fine, which equates to about a $3,500 penalty for each vehicle that was sold in the US. US Deputy Attorney General Jeffrey Rosen said that it is the largest per-vehicle civil penalty judgment ever imposed for a mobile emissions violation under the Clean Air Act.

As part of the settlement agreement, German luxury automaker will fix each of the affected vehicles. This means recalling the vehicles and bringing them into compliance with Clean Air Act emissions standards. US authorities estimated the cost to Daimler to perform these recalls at close to $400 million.

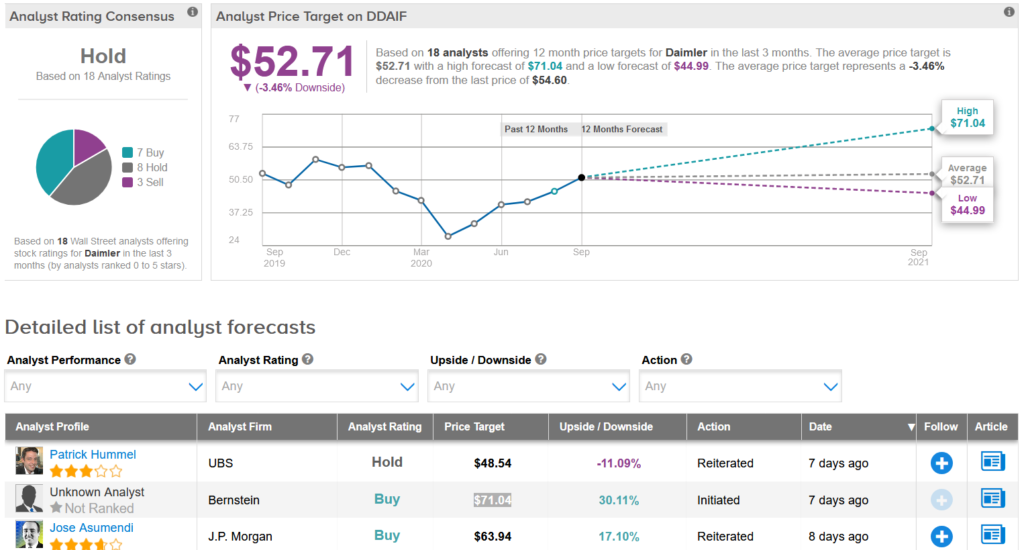

Bernstein recently initiated coverage of Daimler with a Buy rating and a $71.04 price target (30% upside potential), saying that the carmaker is among the companies offering the most earnings upside in the industry. (See Daimler stock analysis on TipRanks)

Bernstein acknowledged that the current environment is causing disruption but “just not the way any doomsayer would have thought”. The firm points to four areas of “self-help” supporting “strong positive operational leverage” for companies in the sector, which are vehicle net pricing, capital allocation, capital expenditures and cash flow.

Overall, Wall Street analysts are sidelined on the stock. The Hold consensus is based on 8 Holds, 7 Buys and 3 Sells. With shares trading slightly above their start-of-the-year level, the $52.71 average price target implies 3.5% downside potential, should the target be met in the coming 12 months.

Related News:

Nikola Drops 9% on Report SEC Is Probing Short-Seller’s Fraud Claims

GM Snaps Up 11% Nikola Stake In Electric Trucks Partnership; Shares Soar

Navistar Pops 14% After Traton Sweetens Buyout Bid To $43 A Share