The Crowdstrike outage and the followed stock decline highlight the benefits of ETF investing. Here’s why: If you decide to invest in an economic sector, you could pick one or two stocks and hope they outperform the market. Instead, you could invest in a diversified ETF that holds an array of stocks in the sector.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The two options raise the age old investment question of buying few stocks versus larger diversification. In baseball terminology, it’s a chance for a grand slam home run, versus knowing you may win the game, but in a solid and unspectacular way.

In the last year or two, you’ve done quite well if you had considered buying chip stock Nvidia (NVDA) and instead bought a microchip ETF to spread risk. But, not nearly as good if you had taken a chance investing in just one stock, Nvidia, that, as it turned out, outperformed the others.

Let’s now discuss the downside, which matters most to many investors. Over the past few days, the CrowdStrike (CRWD) situation has made this relevant.

CrowdStrike Update

CrowdStrike’s stock took a 13% nosedive on Monday following a widespread crash caused by a defective software update last Friday. The incident affected millions of Windows devices and disrupted businesses and industries globally. While the company is struggling to address the issue, analysts are expressing concerns about the potential long-term impact on the company’s reputation and financial performance.

Guggenheim Securities downgraded CrowdStrike’s rating, citing concerns over slowed sales and a damaged image. Less pessimistic, Goldman Sachs (GS) maintained its buy rating but acknowledged potential deal delays.

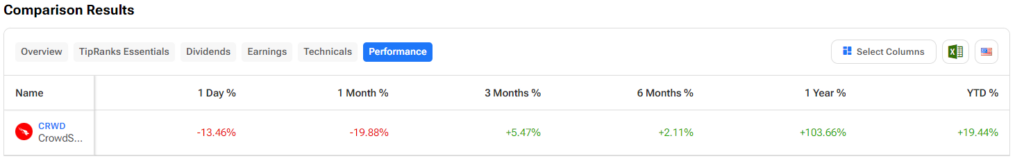

The table above shows CRWD results retrieved from the TipRanks Comparison Tool (Performance Option). It’s clear that on Monday, the stock plummeted nearly 13.50% after being down 11.1% on Friday.

Analysts are divided on CrowdStrike’s prospects. While some believe the company will eventually recover, others caution investors to be wary. The incident has raised questions about the company’s quality control and could erode customer trust. Additionally, the financial implications of the outage, including potential revenue losses and increased costs, remain in question.

The Wisdom of Investing in Cybersecurity

Investing in cybersecurity stocks has been considered a strategic move, with the digital world becoming more precarious. The appeal is that cyberattacks are becoming increasingly sophisticated and frequent, making cybersecurity a growing priority. Plus, the demand for up-to-the-minute solutions will probably never go away. With the increasing digitalization of economies and the expanding attack landscape, the industry is experiencing rapid growth. Cybersecurity can be viewed as recession resistant, a category few industries fall into.

Without picking an individual stock, this is one of many sectors that can be invested in through an exchange-traded fund (ETF) that focuses on the cybersecurity sector.

Diversified Sector ETFs

A sector ETF is an investment fund that allows targeted exposure to an industry or sector within the industry. Below, there is a short listing of sector ETFs investing in companies that are involved in cybersecurity. Investors in these ETFs earn a weighted average return (less a management fee), and a diversified portfolio within a narrowly defined group. On the less attractive side, if one of the holdings goes to the moon, investors get improved performance, but not the full benefit. However, if one drops as CrowdStrike did, investors don’t get the full brunt of the cost.

The first listed ETF is SPDR S&P 500 ETF Trust (SPY), and is included as a benchmark. The following ETFs invest in Cybersecurity as a main objective. One can see from the TipRanks ETF Comparison Tool (Performance Option) that each of these diversified ETFs outperformed the individual CrowdStrike stock shown in the previous Comparison Tool. Yet all of these ETFs, Global X Cybersecurity (BUG), Amplify Cybersecurity (HACK), First Trust NASDAQ Cybersecurity (CIBR), WisdomTree Cybersecurity (WCBR), Xtrackers Cybersecurity Select Equity (PSWD), own CRWD as one of their top ten holdings. Most hold between 5% and 7.25%. The large difference in performance between the individual stock and the sector ETFs represents the power of risk spreading through diversification.

While investors don’t know what outcome any one investment may bring, diversification, which ETFs enhance, is known to lower risk in most cases.

Key Takeaway

Choosing a specific industry to invest in and then examining the available ETFs in that industry is easier than reviewing individual stocks within the same industry. Even if you come up with a favorite company, we know things go wrong. ETFs that invest in an extensive range of industries are a diversified way to protect investors when something goes unpredictably wrong with a company, not the sector.