In the current era of digitization, network infrastructures are highly exposed to cyberattacks. The ongoing conflict between Russia and Ukraine has heightened fears, as Russian-backed hacking organizations are expected increase cybersecurity attacks on U.S. and European businesses and governments.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Amid the rising need for cybersecurity providers, CrowdStrike Holdings, Inc. (NASDAQ: CRWD) has turned triumphant being named a leader in Cybersecurity Incident Response Services by Forrester Research, Inc., an independent research firm.

Forrester states, “CrowdStrike demonstrates a deep understanding of the importance of defensibility throughout the incident response and recovery process…”

Facts on the Ground

CrowdStrike is a U.S.-based cybersecurity firm, which offers cloud-based systems to protect sensitive endpoints and prevent breaches, among other security offerings. Shares of CrowdStrike have gained 27.77% over the past year.

Per the 2022 CrowdStrike Global Threat Report, ransomware-related attacks experienced an 82% rise last year, a statistic which brings with it a plethora of problems and the promise of enterprise investment in security.

The company’s modules offered on the Falcon platform via a SaaS model covers multiple large security markets, including corporate endpoint security, cloud security, security and IT operations, threat intelligence, and identity protection.

Official Comments

CrowdStrike Chief Security Officer and President of CrowdStrike Services, Shawn Henry, said, “With the combination of our Falcon platform, threat hunting experts and best-in-class incident response, CrowdStrike Services is leading the industry in protecting organizations from the most sophisticated threats.”

Wall Street’s Take

Recently, D.A. Davidson analyst Rudy Kessinger reiterated a Buy rating on the stock but lowered his price target to $250 (12.55% upside potential) from $265.

Consensus among analysts currently results in a Strong Buy rating based on 21 Buys and one Hold. The average CrowdStrike price target of $269.68 implies 21.41% upside potential to current levels.

Investor Wisdom

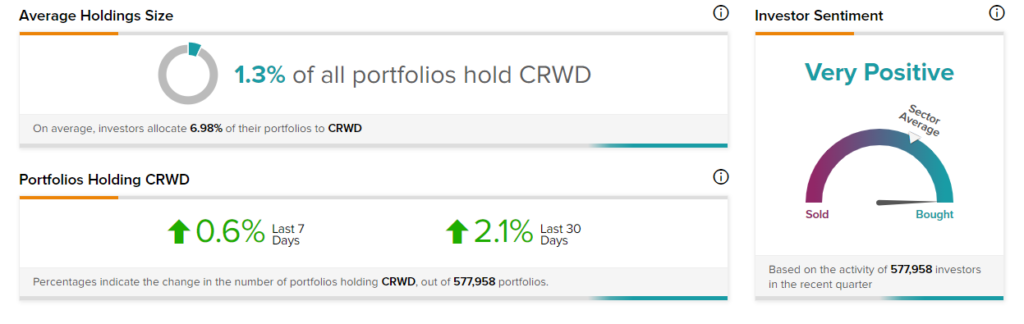

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on CrowdStrike, with 2.1% of investors maintaining portfolios on TipRanks increasing their exposure to CRWD stock over the past 30 days. Furthermore, 0.6% of these individuals have increased their holdings in the recent week.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Apple Fails to Abide by a Dutch Order

Tesla Halts Production at Shanghai Factory Amid China Lockdown – Report

Merck Obtains Positive CHMP Opinion for KEYTRUDA