Costco Wholesale’s (NASDAQ:COST) stock gained about 2% in after-hours trading yesterday following the release of better-than-expected fiscal first-quarter results. Alongside earnings, COST announced a special cash dividend of $15 a share, amounting to nearly $6.7 billion.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Costco is a multinational retail chain that offers a wide range of products, including groceries, electronics, furniture, and more.

Q1 Earnings in Detail

Adjusted earnings of $3.48 per share increased 16.6% in the fiscal first quarter and exceeded the Street’s expectations of $3.41 per share. Meanwhile, Costco’s total revenues increased 6.1% year-over-year to $57.8 billion and marginally surpassed analysts’ expectations of $57.79 billion.

Adjusted comparable sales, a key indicator of retail health, grew by 3.9% year-over-year during the quarter. Furthermore, COST saw a 6.1% jump in e-commerce sales during the quarter. Chief Financial Officer Richard Galanti attributed this upside to increased consumer spending in categories such as televisions, food, and appliances, which constitute the majority of online sales.

One of Costco’s strengths is its membership-based model. It reported an 8% year-over-year increase in membership fees, and global renewal rates remained high at 90.5%. Additionally, COST experienced growth in its membership base, with 72 million paid household members and 129.5 million cardholders, both up nearly 7% from the year-ago quarter.

Is COST Stock a Buy or Sell?

Following the earnings release, two analysts reiterated a Buy rating on COST stock. Analyst Kate McShane of Goldman Sachs remains confident that Costco’s value proposition will continue to positively influence consumers. Also, she believes the company’s operational scale and streamlined stock-keeping unit model position it well to manage cost pressures.

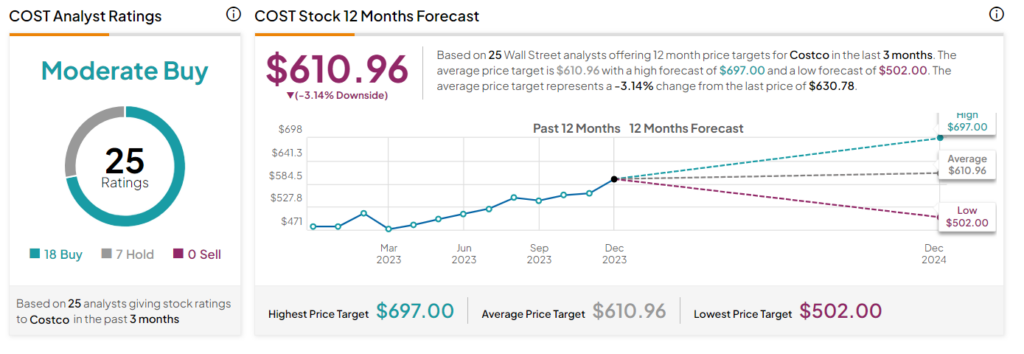

Overall, Wall Street is cautiously optimistic about Costco stock. It has a Moderate Buy consensus rating based on 18 Buys and seven Holds. The average stock price target of $610.96 implies a 3.1% downside potential. COST stock is up 40.2% so far this year.