Artificial intelligence (AI)-powered cloud computing company CoreWeave (CRWV) is scheduled to announce its third-quarter results after the market closes on Monday, November 10. The company went public earlier this year in one of 2025’s largest and most successful IPOs. Its shares have soared nearly 160% from the $40 IPO price. Wall Street expects CoreWeave to post a loss of $0.40 per share on revenue of about $1.29 billion for the quarter.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Strong Revenue Growth but Concerns Remain

It’s important to highlight that CoreWeave’s revenues have been increasing at a fast clip, surging from $395 million in Q2 2024 to $1.2 billion in Q2 2025. Though it is currently operating at a loss, the company had a revenue backlog of $30.1 billion at the end of the second quarter, pointing to a steady demand going forward.

However, several analysts are cautious due to many reasons, including the stock’s steep valuation, high debt levels, and significant dependence on its major customers, such as Microsoft (MSFT).

Recent Event Ahead of Q3

On November 6, CoreWeave signed a $1.17 billion deal with VAST Data to boost its AI cloud operations. Under the deal, CoreWeave will use VAST’s AI Operating System across its data centers to run AI training and inference tasks. The move aims to speed up data use and improve performance for CoreWeave’s customers.

On November 5, CrowdStrike (CRWD) and CoreWeave teamed up to build a secure AI cloud. CoreWeave will provide the computing power, while CrowdStrike will protect it using its Falcon security platform. The goal is to make AI systems faster and safer to use.

On October 30, Core Scientific (CORZ) shareholders voted against CoreWeave’s $9 billion all-stock takeover offer after it failed to win enough support. The bid, first made in July, drew strong criticism from investors who argued it undervalued the company. However, CoreWeave declined to raise its offer, saying the proposal was fair and accurately reflected the Bitcoin miner’s market value.

Mizuho Analysts React Following the Rejection

After the deal fell through, Mizuho Securities analyst Gregg Moskowitz said he expects minimal long-term impact on CoreWeave. He maintained a “Hold” rating and a $150 price target, implying about 14.5% upside. CRWV stock fell 6.3% after the announcement.

While the failed merger removed a chance to lower funding costs and gain infrastructure-based financing, Moskowitz noted that CoreWeave remains focused on its growth plans.

He expects more clarity on the company’s financing and power strategy when it reports third-quarter results on November 10.

Here’s What Options Traders Anticipate Ahead of CRWV’s Q3 Earnings

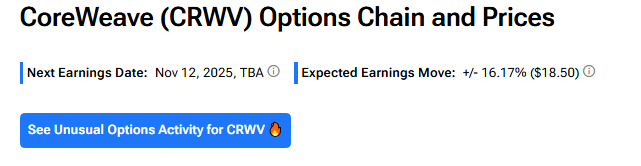

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about a 16.17% move in either direction in CRWV stock in reaction to Q3 results.

Is CRWV a Good Stock to Buy?

Overall, Wall Street has a Hold consensus rating on CoreWeave stock based on 13 Buys, eleven Holds, and one Sell recommendation. The average CRWV stock price target of $156.87 indicates about 50% possible upside from current levels.