Microsoft (MSFT) CEO Satya Nadella saw his total compensation rise 63% during the company’s 2024 Fiscal Year.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Nadella received $79.1 million for the Fiscal year that ended June 30, up 63% from $48.5 million in the previous year, according to a proxy filing made by the technology giant. Most of the Microsoft CEO’s pay was in the form of stock. The cash portion of Nadella’s compensation was reduced by $5.46 million following a series of cyberattacks at the company.

In January, Microsoft disclosed that Russian intelligence had access to some of the company’s executive email accounts. Then, in April, the U.S. Department of Homeland Security reported that China had breached U.S. government officials’ email accounts via Microsoft.

The company also got caught up in the massive information technology (IT) outage this July that stemmed from a technical update by cybersecurity firm CrowdStrike (CRWD).

Prioritizing Security

Nadella has responded to the cyber issues by stressing that security is a top focus and priority of Microsoft. This past summer, the company said that it will consider employees’ cybersecurity efforts when determining their remuneration.

As for Nadella himself, the cash portion of his compensation was supposed to be $10.66 million. But Microsoft’s board of directors approved only $5.2 million in cash owing to the cyberattacks this year. MSFT stock has risen 15% so far in 2024.

Is MSFT Stock a Buy?

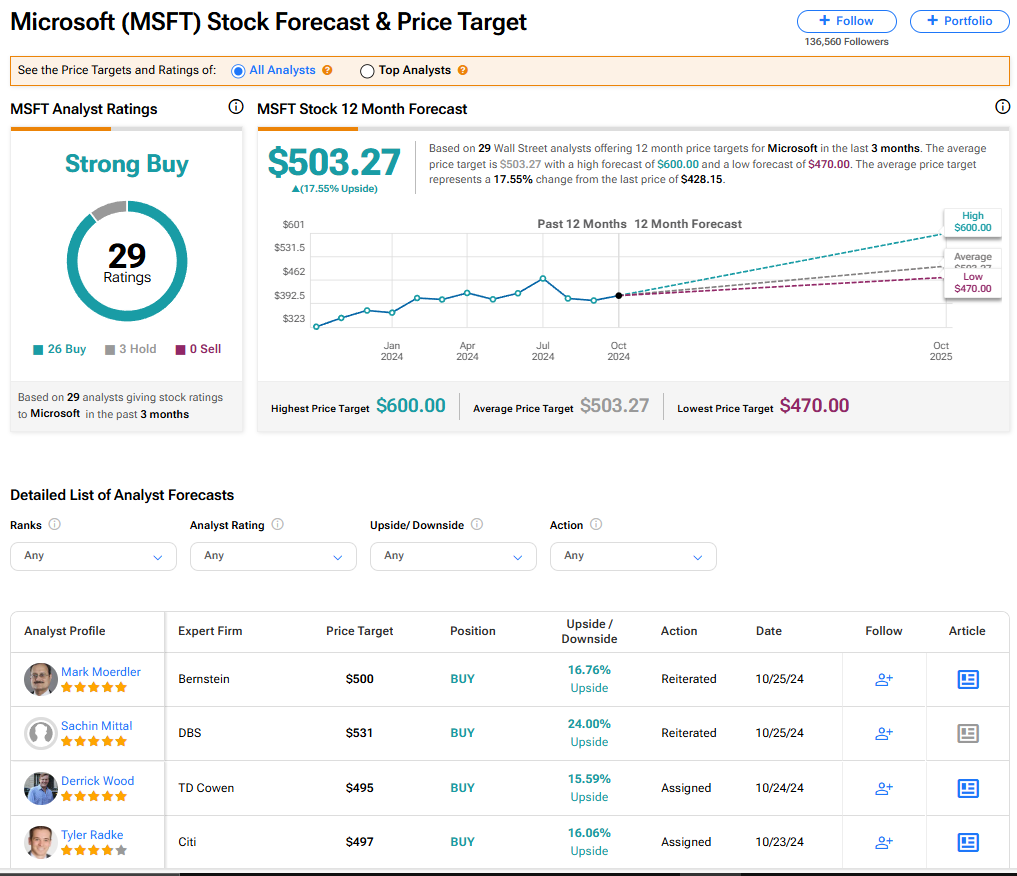

Microsoft stock has a consensus Strong Buy rating among 29 Wall Street analysts. That rating is based on 26 Buy and three Hold recommendations issued in the past three months. There are no Sell ratings on the stock. The average MSFT price target of $503.27 implies 17.55% upside from current levels.