It may be one of the broadest, most sweeping plans in television, but cable and internet provider Comcast (CMCSA) is officially spinning off its cable arm. Not only that, Comcast will also be staging some “leadership changes.”

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Basically, what Comcast had already suggested has now come to pass. Multiple channels will be impacted by this spinoff, including CNBC, MSNBC, USA, SyFy, and several other specialty channels. These operations between them brought in around $7 billion worth of revenue for the year ended September 30.

However, some channels will stay with Comcast. Broadcast giant NBC will remain part of Comcast, as well its streaming service, Peacock. Comcast will also be retaining the Bravo network. Essentially, Comcast believes that its other businesses—movies and theme parks—will do better without the cable arm.

The Best Move?

The spinoff of traditional TV assets will allow Comcast to focus on its higher-growth operations, which cable simply is not any more. Further, Comcast trades at a “conglomerate discount,” meaning that it is not worth what all its components together are worth. Thus, by getting rid of the TV networks, it reduces that discount.

Craig Moffett, founder of MoffettNathanson, declared “Cable is in secular decline, so it makes sense to try to carve off that piece of the business and highlight the remaining part of Comcast, which has a much better growth profile.”

Is Comcast Stock a Good Buy?

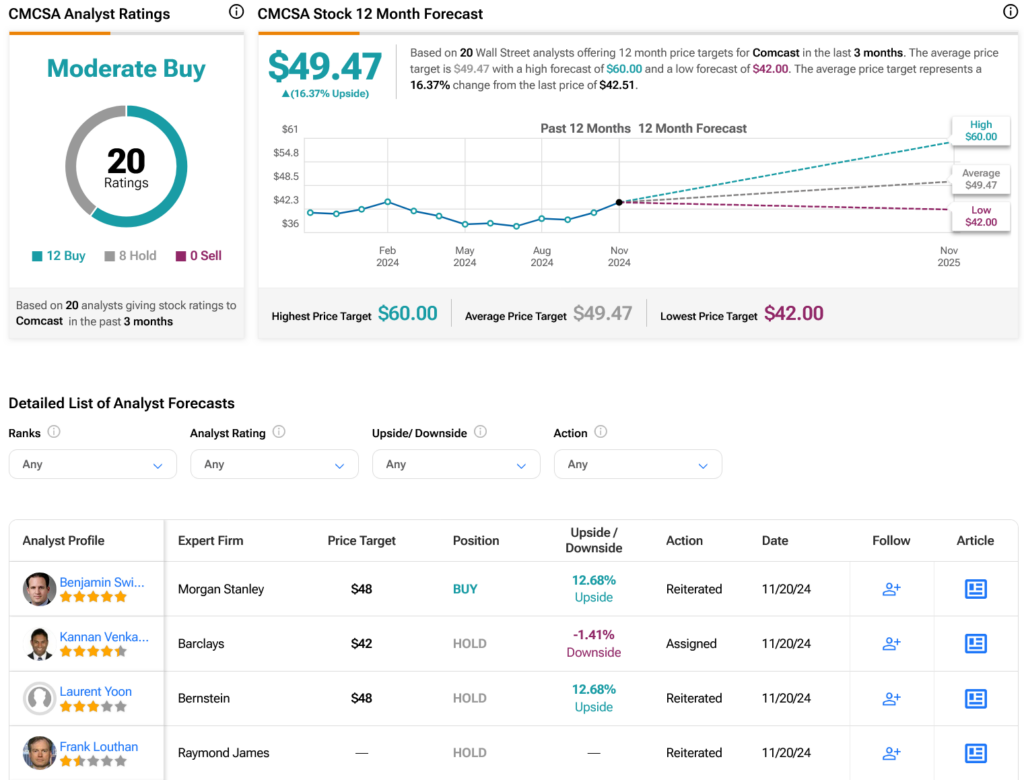

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CMCSA stock based on 12 Buys and eight Holds assigned in the past three months, as indicated by the graphic below. After a 3% rally in its share price over the past year, the average CMCSA price target of $49.47 per share implies 16.37% upside potential.