With the U.S. election now underway, we are getting our first look at who will be running the country for the next four years. It is also a race that cryptocurrency exchange Coinbase Global (COIN) has put quite a bit into. And that political presence is giving COIN stock a huge surge, up nearly 5.5% in trading on November 5.

We already knew that Coinbase was going big on the 2026 midterms. But it also invested a lot in the 2024 election as well. Coinbase CEO Brian Armstrong saw the writing on the wall back in 2018 and realized that Coinbase was going to have to be a political player if it wanted to keep regulators from trampling its operations.

Coinbase put $75 million behind Fairshake, a crypto-heavy political action committee (PAC) that is working to elect crypto-friendly officials. Armstrong himself put $1.3 million behind a series of candidates on the ballot this election cycle. All of this comes at a time when there are increasing numbers of competitors looking to get in on Coinbase’s action.

And This Is Probably Why

A report from Bitcoin.com revealed that there was good reason for Coinbase to push as hard as it is into political lobbying. The report detailed 20 different “shameful regulator moves against crypto,” and featured some absolutely staggering reports.

For instance, on over 20 different occasions, Coinbase found examples where the Federal Deposit Insurance Corporation (FDIC) told member banks to either “pause,” “refrain from providing,” or “not proceed” with plans to offer cryptocurrency-related banking services. Given that the FDIC is the organization that ensures deposits held in a bank, the organization’s word carries a lot of weight.

Is Coinbase Stock a Good Buy?

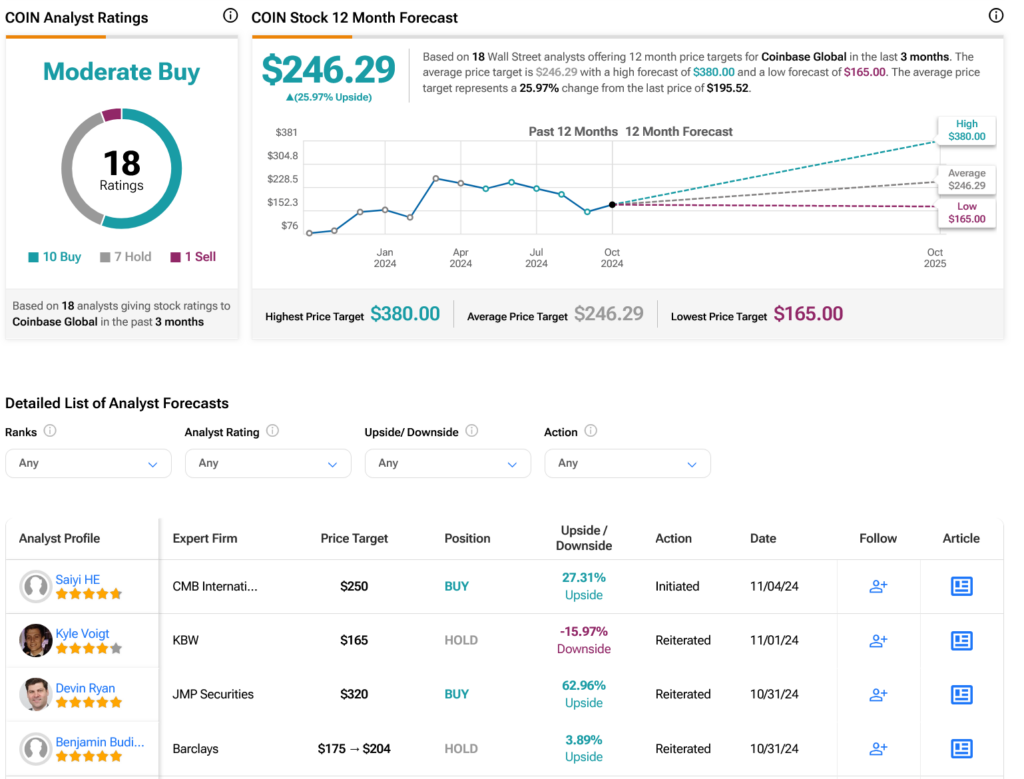

Turning to Wall Street, analysts have a Moderate Buy consensus rating on COIN stock based on 10 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 127.36% rally in its share price over the past year, the average COIN price target of $246.29 per share implies 25.97% upside potential.