Cryptocurrency exchange Coinbase (COIN) has a lot on its plate right now, and the news is not always great. In fact, with the latest reports today that Coinbase will indeed have to face down a lawsuit from shareholders, shares fell nearly 5% in Friday morning’s trading.

The latest word comes from Newark, New Jersey District Judge Brian Martinotti, who ruled that Coinbase would indeed have to face a class-action lawsuit posed by shareholders. The lawsuit alleges that Coinbase downplayed the potential risks of a lawsuit from the Securities and Exchange Commission (SEC). Martinotti offered up a 50-page decision, noting that shareholders may also be able to pursue claims about assets stored with the company.

Essentially, Martinotti declared that the shareholders had adequately presented evidence that Coinbase, along with its executives, presented “…a favorable picture of the improbability that the SEC would file an enforcement action by repeatedly emphasizing that the crypto assets they listed were not securities.” However, reports noted that the judge dismissed claims that Coinbase “…falsely denied it engaged in proprietary trading.”

Going After Policy Changes

But Coinbase is not taking the legal battles lying down. It plans to continue its strategy of actively pursuing lobbying efforts and changes to U.S. policy. In fact, it will continue what it calls an “elevated policy spend” throughout the U.S. presidential election and beyond.

Coinbase’s chief financial officer, Alesia Haas, noted that the appropriate regulation would make the operating environment clearer. Thus, Coinbase is glad to have a seat at the table, so to speak, in making that regulation happen. Just back in June, Coinbase put $25 million behind Fairshake, a political action committee (PAC) that focuses on the cryptocurrency market.

Is Coinbase a Buy, Sell, or Hold?

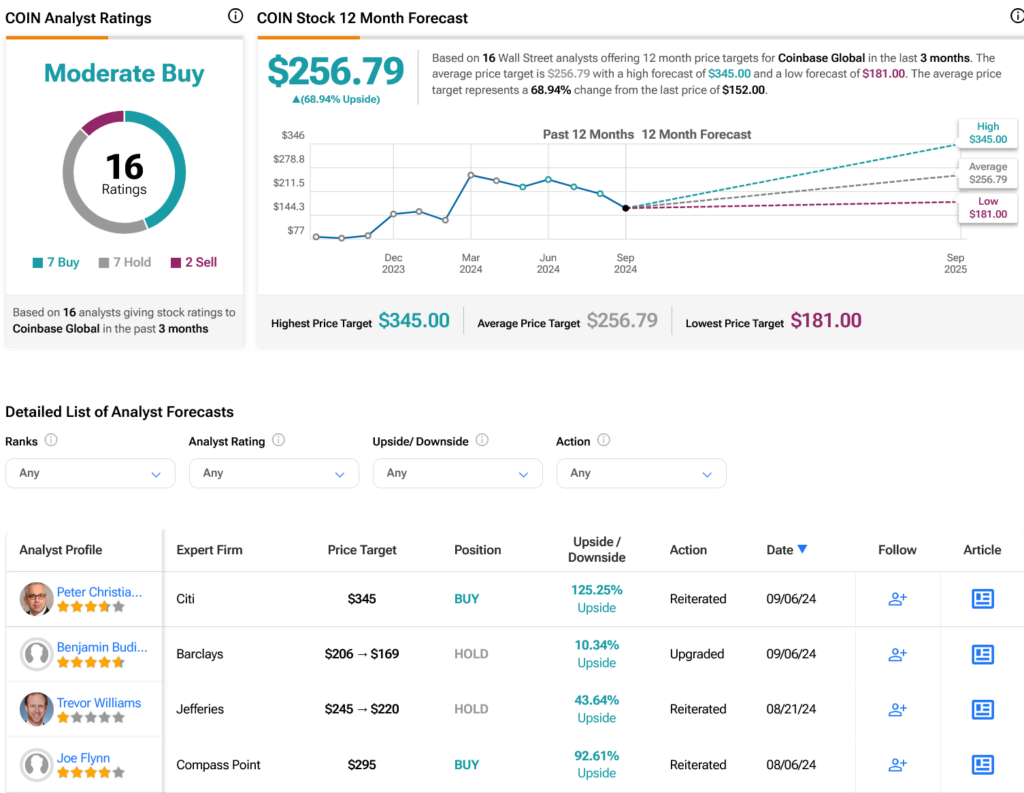

Turning to Wall Street, analysts have a Moderate Buy consensus rating on COIN stock based on seven Buys, seven Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After an 87.26% rally in its share price over the past year, the average COIN price target of $256.79 per share implies 68.94% upside potential.