Coherent, the provider of lasers and laser-based technologies, deemed the revised buyout offer from II-VI Incorporated on March 11 as a “Company Superior Proposal.”

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Per the terms of the revised proposal, the manufacturer of engineered materials and optoelectronic components will pay $195 in cash and 1 share of II-VI for each share of Coherent (COHR), instead of the $170 in cash and 1.0981 shares offered on March 8.

Coherent intends to terminate the revised merger agreement with California-based manufacturer and seller of optical and photonic products, Lumentum Holdings (LITE), entered into on March 10. The company has said the same to Lumentum unless Coherent receives a favorable revised proposal from Lumentum by March 17, 2021. As per the terms of the revised agreement, each share of Coherent common stock was to be exchanged for $175 in cash and 1.0109 shares of Lumentum common stock.

Coherent previously agreed to be acquired by Lumentum for $100 in cash and 1.1851 shares of Lumentum common stock for each share of Coherent this January, but this agreement was terminated in March. (See Coherent stock analysis on TipRanks)

The termination fee to be paid to Lumentum on Coherent’s acceptance of a competing acquisition proposal remains unchanged from Coherent’s original merger agreement with Lumentum, the company said.

Last month, Coherent also received an unsolicited acquisition proposal from MKS Instruments, in which each share of Coherent common stock was offered to be exchanged for $115 in cash and 0.7473 per share of MKS Instruments (MKSI) common stock. Further, MKSI’s revised proposal offered each share of Coherent common stock to be exchanged for $135 in cash and 0.7516 of a share of MKS common stock.

Therefore, after a thorough review of all proposals, the COHR’s board of directors, in consultation with financial and legal advisors, unanimously determined II-VI’s (IIVI) revised acquisition proposal on March 11 to be the best fit.

Following the revised proposal from II-VI on March 11, Benchmark Co. analyst Mark Miller maintained a Hold rating on the stock.

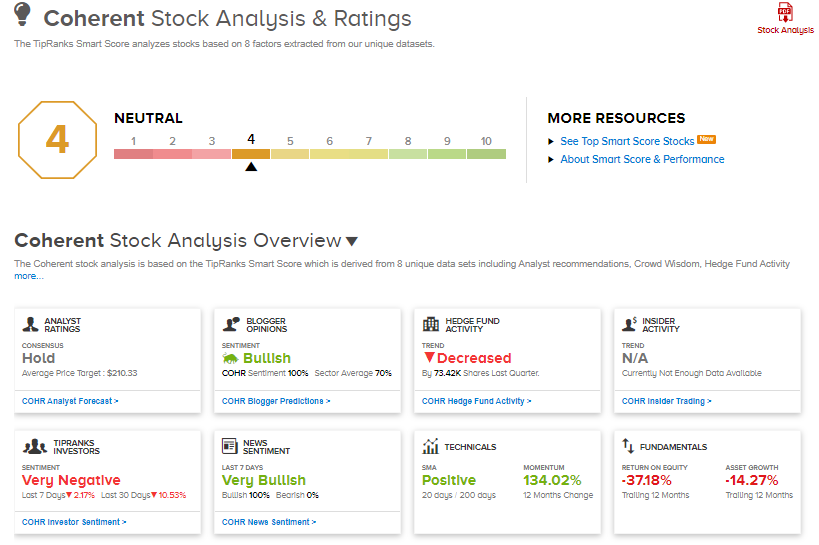

Meanwhile, the consensus rating on the stock is a Hold. That’s based on a unanimous 6 Holds. Looking ahead, the average analyst price target stands at $210.33, putting the downside potential at about 15.2% over the next 12 months. Shares have jumped 67.3% so far this year.

According to TipRanks’ Smart Score system, Coherent gets a 4 out of 10, which indicates that the stock is likely to perform in line with market averages.

Related News:

Dropbox To Snap Up DocSend For $165M; Shares Gain 4%

DuPont Inks $2.3B Deal To Snap Up Laird Performance Materials; Shares Gain

Chevron Inks Deal To Buy Noble Midstream Partners; Shares Gain 4%