Coca-Cola (NYSE: KO) posted better-than-expected results in the fourth quarter of 2021, driven by price increases, though elevated commodity and transportation costs acted as headwinds. Remarkably, the volume of sales in restaurants and other eat-in venues during the quarter surpassed 2019 levels.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Results in Detail

Coca-Cola reported Q4 adjusted earnings of $0.45 per share, topping the Street’s estimate of $0.41 per share. The company recorded earnings of $0.47 per share in the same quarter last year.

Adjusted net operating revenues increased 9% year-over-year to $9.46 billion, ahead of analyst expectations of $8.95 billion. Growth in price/mix was partly offset by a decline in concentrate sales. Also, global unit case volume grew 9%.

Meanwhile, adjusted operating margins during the quarter contracted to 22.1% from 27.3% year-on-year, mainly driven by elevated marketing investments. Adjusted gross margin fell 10 basis points to 57.3%.

For 2021, Coca-Cola posted adjusted earnings of $2.32 per share, up 19% year-over-year. Additionally, adjusted net operating revenues surged 16% to $38.7 billion. Growth in concentrate sales and price/mix drove the results.

CEO’s Comments

Coca-Cola CEO James Quincey said, “In 2021, our system demonstrated resilience and flexibility by successfully navigating through another year of uncertainty…We are confident that progress on our strategic transformation has made us a nimbler total beverage company. While the environment remains dynamic, we will build on the momentum from 2021 to drive topline growth and maximize returns.”

Guidance

For 2022, the company projects adjusted EPS to grow 5% to 6%, including a 3%-4% unfavorable currency movements. Organic revenue is anticipated to reflect 7% to 8% growth. Free cash flow is expected at $10.5 billion.

Looking forward, CEO James Quincey commented, “Further recovery in 2022 will be determined by macro factors, including overall consumer sentiment as well as supply chain challenges; labor shortages; and of course, the inflationary pressures in interest rates. We are confident we are well equipped to navigate this environment and deliver on the guidance we provided today.”

“To complement our World Without Waste goals, we announced a new global goal to reach 25% reusable packaging by 2030,” Quincey added.

Wall Street’s Take

Following the strong Q4 results, Guggenheim analyst Laurent Grandet maintained a Buy rating on Coca-Cola and lifted the price target to $67 (9.16% upside potential) from $66.

Grandet recently upgraded the company and maintained a positive stance saying, “We see the materialization of our thesis, specifically the gross margin benefit KO is getting from its incidence model and the recent acquisition of Body Armor.”

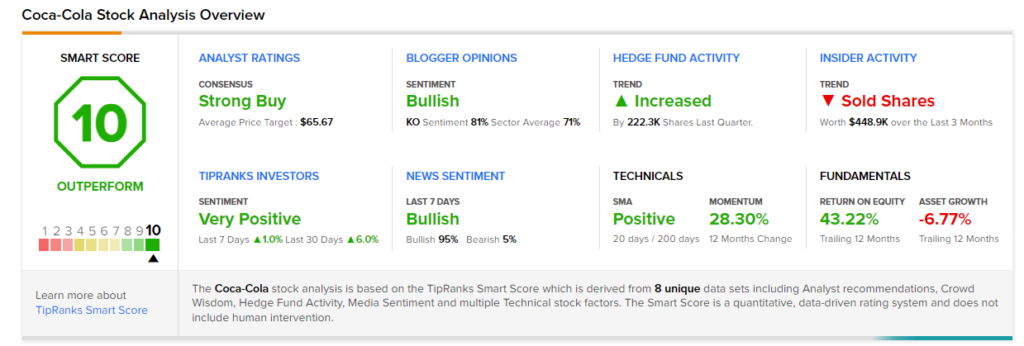

Consensus among analysts is a Strong Buy based on 10 Buys versus 2 Holds. The average Coca-Cola price target stands at $65.75 and implies upside potential of 7% to current levels. Shares have increased 26.4% over the past year.

Smart Score

Coca-Cola scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Mandiant Books Lower-than-Expected Q4 Loss; Shares Rise

Zynga Posts Record Q4 Results on Historic Bookings; Website Visits Hinted at It

AstraZeneca’s Q4 Results Outperform; Shares Rise Pre-Market