Beverage giant Coca-Cola (KO) is raising €1 billion through a new debt issuance, the Financial Times reported. The company will issue two senior unsecured Eurobonds of €500 million each, maturing in 13 and 29 years. This move is intended to strengthen KO’s financial position as it faces a potential $16 billion tax dispute with the U.S. Internal Revenue Service (IRS).

This amount of $16 billion stems from allegations that Coca-Cola shifted profits to low-tax jurisdictions, primarily Ireland. The IRS accuses the company of aggressive tax avoidance through manipulation of transfer pricing to reduce its U.S. tax liability.

Interestingly, the debt issuance highlights a trend of U.S. companies tapping the euro-denominated bond market for lower borrowing costs. Coca-Cola is among firms like Johnson & Johnson (JNJ) and Booking Holdings (BKNG) that have collectively raised €30 billion through such transactions this year.

Coca-Cola’s Rising Debt

It is worth highlighting that Coca-Cola has already raised $7 billion this year, especially for tax-related payments. The company aims to use the proceeds to fund the Fairlife acquisition’s final payment, due in 2025, and pay off other outstanding debt obligations.

The company has not yet recorded the potential tax liability on its income statement due to its intention to appeal the ruling. Nevertheless, the outcome of this case is expected to have a major impact on KO’s bottom line.

What Is the Future Forecast for KO Stock?

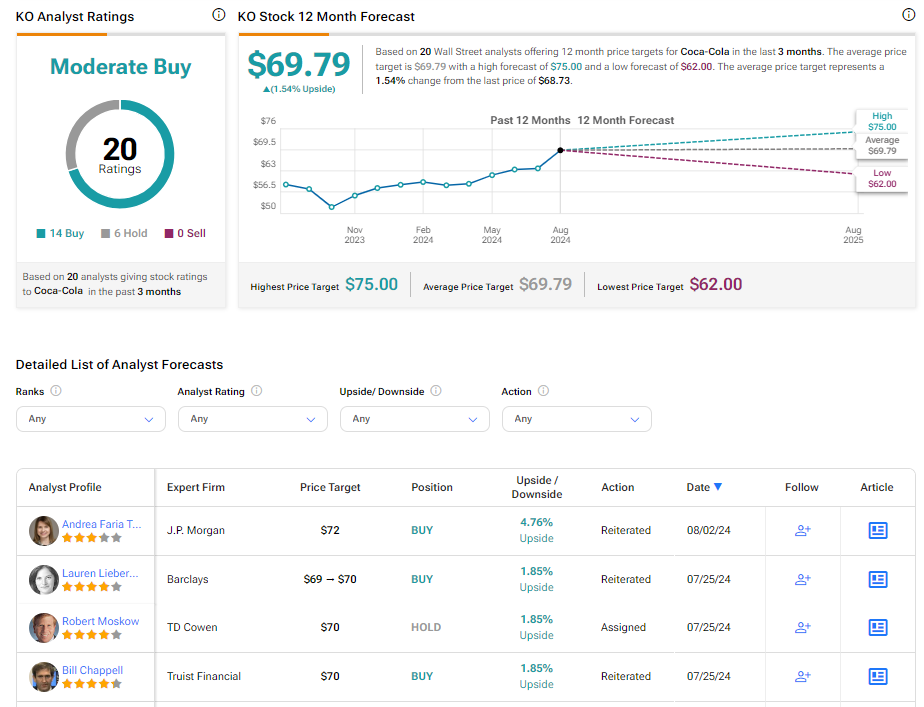

After a year-to-date rally of 18.5%, Wall Street analysts’ average price target on Coca-Cola stock of $69.79 implies a limited upside potential of 1.54% from current levels.

Overall, KO has received 14 Buy and six Hold recommendations for a Moderate Buy consensus rating.