Chipotle Mexican Grill (NYSE:CMG) delivered better-than-expected Q1 financial results despite inflationary headwinds. Thanks to the ongoing momentum in its business, the quick-service restaurant chain operator raised its full-year comparable restaurant sales outlook. As a result, CMG stock gained 3.05% in Wednesday’s after-hours trading.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

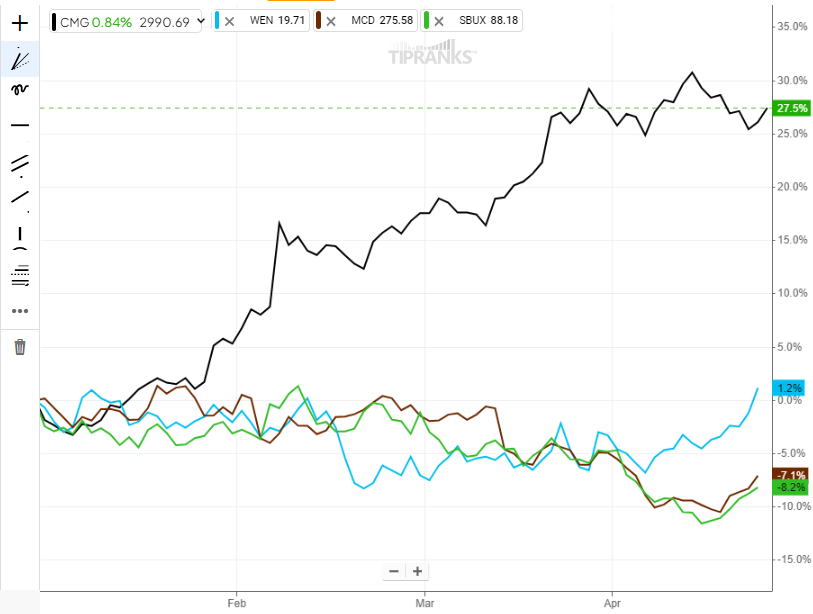

It’s worth noting that CMG stock has gained about 27.5% year-to-date, outperforming its peers, including Wendy’s (NASDAQ:WEN), McDonald’s (NYSE:MCD), and Starbucks (NASDAQ:SBUX). Wendy’s stock is up about 1.2% year-to-date. At the same time, MCD and SBUX stocks fell 7.1% and 8.2%, respectively.

Chipotle’s sticky customer base and improving throughput in its restaurants have driven its comparable sales and share price.

With this background, let’s delve into CMG’s Q1 performance.

CMG’s Sales and EPS Exceed Expectations

CMG delivered total revenue of $2.7 billion in the first quarter, up 14.1% year-over-year. The 7% increase in comparable sales and new restaurant openings drove its top line in Q1. The increase in comparable sales was driven by a 5.4% improvement in transactions and a 1.6% growth in average checks. Further, CMG’s total revenue exceeded analysts’ average estimate of $2.68 billion.

Chipotle delivered adjusted EPS of $13.37, up over 27% year over year, driven by higher sales and improved restaurant-level margins. Moreover, its EPS surpassed analysts’ average estimate of $11.69.

Outlook

Chipotle’s management highlighted that the momentum in its business has continued into April. As a result, the company increased its full-year comparable sales outlook.

CMG now projects its comparable sales to increase by a mid- to high-single-digit rate. Earlier, the company expected its comparable sales to grow at a mid-single-digit rate.

Is Chipotle a Buy, Sell, or Hold?

Given the ongoing macro headwinds, analysts are cautiously optimistic about CMG’s prospects.

Chipotle stock has 19 Buy and nine Hold recommendations for a Moderate Buy consensus rating. The average price target on CMG stock is $3,036.37, implying a limited upside potential of 3.75% from current levels. Chipotle stock is up over 64% in one year.