Shares of the Close Brothers Group (GB:CBG) continued to gain momentum after analyst Benjamin Toms from RBC Capital upgraded his rating on the stock from Hold to Buy yesterday. Toms also raised his price target for CBG stock from 375p to 620p, now predicting an upside of 14%. CBG stock surged over 4% as of writing, after gaining over 7% in Thursday’s trading session.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Close Brothers Group plc is a UK merchant bank offering a variety of financial services, including lending, wealth management, and securities trading.

RBC Turns Bullish on Close Brothers

Year-to-date, CBG stock has declined 30%, mainly after the FCA (Financial Conduct Authority) announced a car finance probe on the bank in January. However, RBC believes the market has overreacted and stated that CBG shares appear undervalued.

RBC Capital is currently bullish on CBG, considering the potential catalysts such as the possible easing of Basel 3.1 regulations and approval of the Internal Ratings-Based (IRB) approach. Basel 3.1 pertains to regulations for calculating risk-weighted assets in the banking and finance industry, while IRB lets companies use their own models to estimate the risk of credit exposures. These factors could enhance the company’s performance and market outlook.

The FCA will reveal its next steps on the car finance review in May 2025. RBC projects that Close Brothers will allocate £250 million in provisions over 2025 and 2026.

Toms also highlighted that Close Brothers’ net interest margin (NIM) remains resilient despite a falling rate environment, which is structurally beneficial for the company. This stability amid changing interest rates reinforces the positive outlook for the stock.

TipRanks Provides Insights on Analyst Rankings

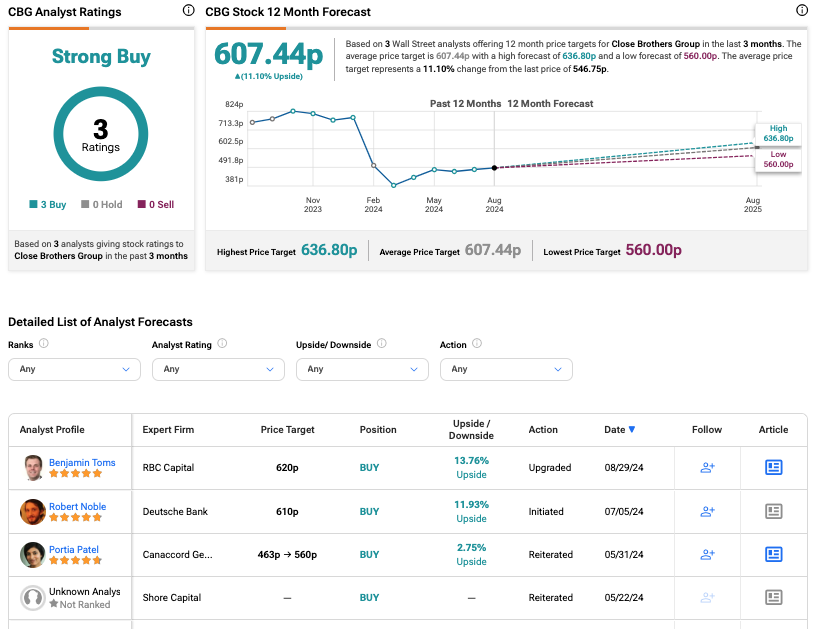

As per TipRanks, Toms is a five-star-rated analyst. TipRanks’ ranking system helps to track the performance of various financial experts, who are ranked based on their success rate, average returns, and statistical significance.

Over the last year, Toms has achieved a 29% success rate, ranking him among the most accurate and profitable analysts for CBG stock.

Is Close Brothers a Good Stock to Buy?

According to the TipRanks, CBG stock has been assigned a Strong Buy consensus rating, backed by three Buy recommendations. The Close Brothers share price forecast is 607.44p, which indicates 11% upside potential from the current price level.