Citigroup (NYSE: C) reported better-than-expected results for the first quarter of 2022, with both an earnings and revenue beat. Following the news, shares of the global investment bank rose 1.56% to close at $50.93 on Thursday.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Results in Detail

Citigroup reported earnings of $2.02 per share in the quarter, handily beating the Street estimates of $1.55 per share but declining 44% year-over-year. Net income of $4.3 billion dropped 46% on the back of elevated cost of credit, higher expenses, and reduced revenues. Results were impacted by around $677 million ($588 million after-tax) related to consumer divestiture.

Revenues came in at $19.2 billion, down 2% year-over-year but surpassed analysts’ expectations of $18.15 billion. Lower non-interest revenue across businesses was recorded, partly offset by elevated net interest income.

Net interest margin came in at 2.05%, up three basis points.

Segment-wise, the company’s Personal Banking, and Wealth Management segment recorded revenues of $5.9 billion, down 1% year-over-year, impacted by a reduction in non-interest revenues, partly offset by higher net interest income. Revenues of $1.93 billion were recorded in the Legacy Franchises segment, down 14%.

On the dismal performance of investment banking, corporate banking, and markets revenues, the Institutional Clients Group segment’s revenues declined 2% to $11.16 billion. Less client activity in capital markets due to geopolitical and macroeconomic ambiguity was partly mitigated by higher advisory fees.

On the contrary, Services revenues of $3.45 billion surged by 15%. Net interest income on elevated deposits balance and spreads, along with strong fee growth, acted as tailwinds.

Furthermore, net credit losses decreased 50% year-over-year to $872 million in the quarter.

On the negative side, Citigroup’s expenses grew 15% year-over-year to $13.17 billion. If you exclude the impact of Asia divestitures, costs surged 10%. Continued investments in the bank’s transformation, business-led investments, and volume-related expenses increased cost pressure. Yet, productivity savings offset the rise partially.

Other Metrics

Citigroup reported total loans of $660 billion, down 1% from the prior-year quarter. Meanwhile, total deposits grew 3% to $1.33 trillion.

The Common Equity Tier 1 Capital ratio and Supplementary Leverage ratios (SLR) stood at 11.4% and 5.6%, respectively.

Return on average common equity and the return on average tangible common equity (RoTCE) for the quarter came in at 9% and 10.5%, respectively.

During the quarter, Citigroup repurchased around 50 million common shares, giving back approximately $4 billion to common shareholders as repurchases and dividends.

Official Comments

Looking forward, Citigroup CEO Jane Fraser commented, “While we are making necessary investments in our infrastructure, risk and controls, and our businesses, we remain committed to improving our returns over the medium term.”

For 2022, management still expects revenue to grow in the low single-digits and mid single-digit growth in expenses, both excluding divestiture-related impact.

Wall Street’s Take

Following the Q1 earnings report, CFRA maintained a Buy rating on Citigroup but reduced the price target to $62 (21.74% upside potential) from $76.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on eight Buys, seven Holds, and one Sell. The average Citigroup stock price forecast of $70 implies 37.44% upside potential from current levels. Shares have decreased ~30% over the past year.

Bloggers Weigh In

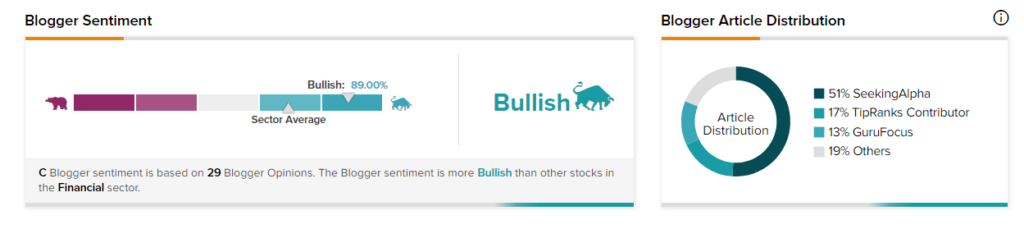

Bloggers seem enthused by the company’s earnings results. TipRanks data shows that financial blogger opinions are 89% Bullish on Citigroup, compared to a sector average of 70%.

The Bottom Line

Citigroup’s strategic moves, operational restructuring, and robust deposit balance, along with high analyst ratings, are factors to be considered when investing in this stock.

However, investors might be wary about relatively lower rates and high inflation, along with the bank’s capital markets business, investment banking, and banking revenues.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

JPMorgan Misses Q1 Earnings on Macro Issues

Wells Fargo Drops on Disappointing Revenues, Fee Income Falters

General Motors & Glencore Charging Up Together for EV Push