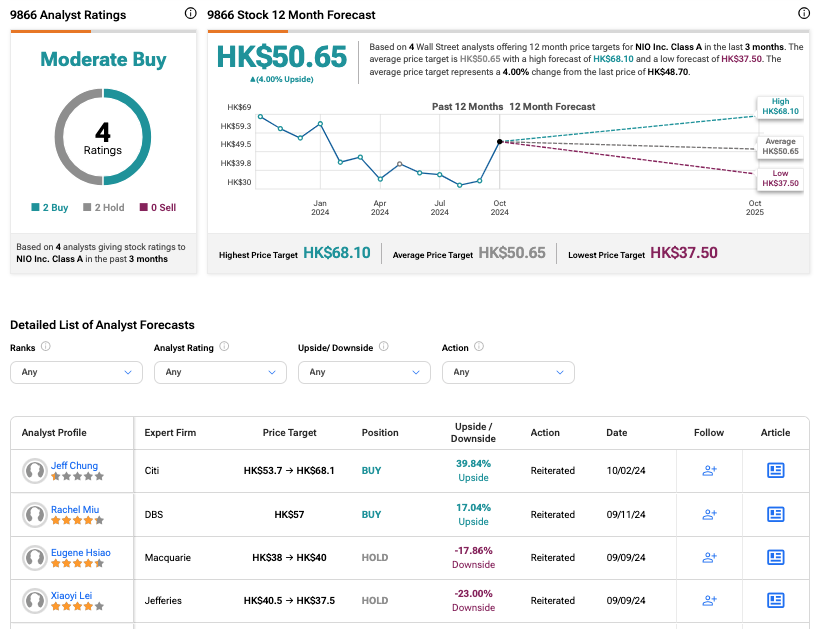

Hong Kong-based automaker NIO Inc. (HK:9866) recently received a Buy rating from Citi, predicting a 40% surge in its share price. Earlier this month, analyst Jeff Chung from Citi reiterated a Buy rating while raising the price target on the stock from HK$53.7 to HK$68.1.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

NIO is a Chinese automotive company known for its premium smart EVs.

NIO Reports Impressive Numbers for September

NIO recently announced its September delivery update, exceeding 20,000 deliveries for the fifth consecutive month. Meanwhile, the company will achieve the milestone of its 600,000th vehicle delivery on October 11.

In September, NIO delivered 21,181 vehicles, with 20,349 coming from the NIO brand and 832 from the ONVO brand. The company started delivering its first mass-market SUV under the ONVO brand in September, with the new brand expected to compete with Tesla’s (TSLA) Model Y.

Moving forward, Nio is highly optimistic about its ONVO brand and aims to surpass the milestone of 10,000 units per month by December.

Citi Remains Bullish on NIO

Citi analysts think that NIO’s ONVO could gain from the positive consumer sentiment during this year’s National Day Golden Week. Additionally, if ONVO performs as expected, this could further enhance investor confidence in the company’s new sub-brand, Firefly.

Furthermore, Chung raised its 2024 projected price-to-earnings (PE) multiple from 1.4x to 1.6x, considering the traditional peak sales season for the auto industry in the fourth quarter. Also, the recent Tesla’s Robotaxi event could enhance market sentiment.

DBS Aligns with Citi on ONVO’s Growth

Like Chung, DBS analyst Rachel Miu is also optimistic about the company’s ONVO brand, predicting it will boost NIO’s Q4 sales in 2024. DBS projects that ONVO L60 deliveries will be approximately 20,000 units in the second half of 2024. The firm expects NIO’s total deliveries to reach 224,000 units in Fiscal 2024, representing a 40% increase from the previous year.

Is NIO a Good Stock to Buy?

As per the consensus among analysts on TipRanks, 9866 stock has been assigned a Moderate Buy rating. The NIO share price target is HK$50.65, which implies an upside of 4% from the current price level.