Tech firm Cisco Systems (CSCO) has agreed to invest in AI (artificial intelligence) startup CoreWeave in a funding round that assigns it a hefty $23 billion valuation. Cisco is the latest company to join the bandwagon of big tech firms that are increasing investments in AI startups. CEO Michael Intrator-led CoreWeave is considering a secondary offering, which allows existing shareholders to sell up to $400 to $500 million in shares.

Bloomberg was the first to report about Cisco’s investment in CoreWeave. New Jersey-based CoreWeave is a cloud computing provider that builds data centers and other AI infrastructure. It uses Nvidia’s (NVDA) powerful graphic chips to build the infrastructure, enabling advanced computing capabilities. Early investors of CoreWeave include Nvidia, Magnetar Capital, Coatue Management, Jane Street, and Fidelity. The startup is even considering a U.S. IPO (initial public offering) as early as next year.

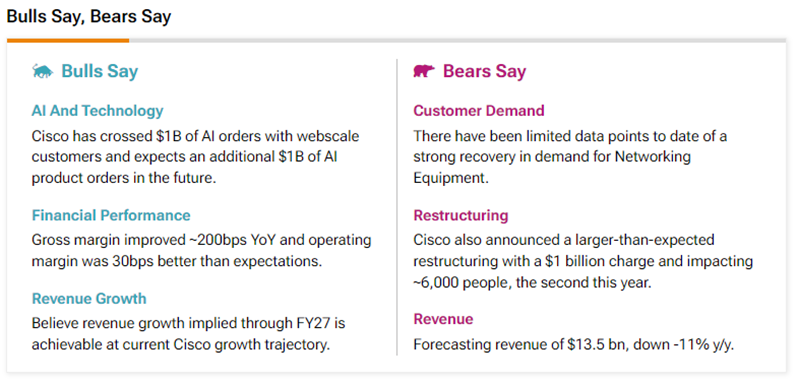

Insights from TipRanks’ Bulls Say, Bears Say Tool

Cisco is in the race to become a prominent name in the fast-paced data center infrastructure market. The company hopes its exposure to CoreWeave-like investments will boost the demand for its networking products.

According to TipRanks’ Bulls Say, Bears Say tool, bulls are excited about Cisco’s opportunity to earn higher AI revenues. Moreover, analysts are optimistic about improving gross and operating profit margins and believe that Cisco’s implied revenue growth through 2027 is attainable based on its current growth trajectory.

On the other hand, bears are concerned about the slow recovery in demand for Networking Equipment such as those offered by Cisco. Plus, they are worried about the larger-than-expected restructuring costs and layoffs announced recently. Bears also seem unhappy with the Q1 FY25 revenue forecast.

Is CSCO a Good Stock to Buy?

Wall Street remains split on Cisco stock’s trajectory as seen from the varying views revealed by the Bulls Say, Bears Say tool. On TipRanks, CSCO stock has a Moderate Buy consensus rating based on seven Buys versus nine Hold ratings. The average Cisco Systems price target of $55.71 implies 6.3% upside potential from current levels. Meanwhile, CSCO shares have gained 7.2% so far this year.