With the chip shortage likely still fresh in most investors’ memories, word that the U.S. government is putting together a hefty new research and development fund for semiconductor advancement should be treated as good news. However, that’s not how the market is taking it; chip stocks are looking mixed in Friday’s trading session.

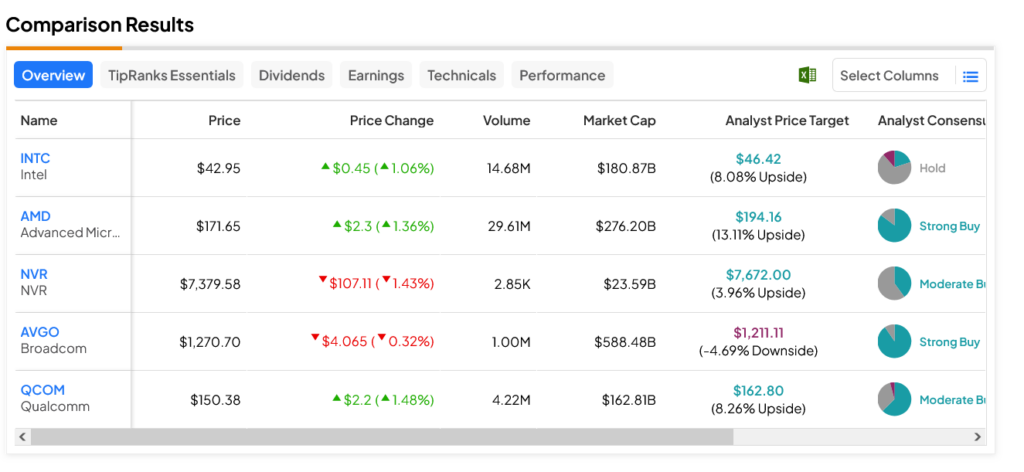

Intel (NASDAQ:INTC), AMD (NASDAQ:AMD), and Qualcomm (NASDAQ:QCOM) are all up modestly in Friday’s trading session. However, Broadcom (NASDAQ:AVGO) is down fractionally, while NVR (NYSE:NVR) is down significantly, suggesting that not everyone is likely to benefit equally from the planned infusion of R&D cash.

The reports point to a new plan out of the Biden Administration that will feature $5 billion going into semiconductor research, thanks to provisions in the CHIPS and Science Act. The cash will go into a “public-private consortium” that will ultimately spur development in the next generation of computer chips. Such efforts are set to include chip design, creating prototypes of said designs, and job training programs to ensure that there’s a sufficiently educated workforce to handle these new chips and their designs once they’re actually created.

The Chip Sector Is on a Comeback Trail

This sounds like good news, and on a certain level, it is. Though it’s easy to wonder why the government is getting involved with taxpayer dollars at this point, especially given that the chip sector is on a comeback trail as it is. Just over a month ago, a report from Semiconductor Intelligence noted that “everything points to the slowdown we’ve just been through being over and things picking up.” Of course, the report also noted that “…people are cautious about the economy, which will likely hamper some sales.”

But if there’s a recovery in the sector, then chip stocks should have their own cash to funnel into research and development; why the Biden Administration thinks it’s time for a hefty taxpayer-funded investment into the chip sector is less than clear.

Which Chip Stocks Are a Good Buy Right Now?

Turning to Wall Street, the laggard in this set is AVGO stock, as this Strong Buy stock with a $1,211.11 average price target offers a 4.69% downside risk. Meanwhile, AMD stock is the leader, as this Strong Buy offers a 13.11% upside potential on its $194.16 average price target.