Chinese AI startup DeepSeek has been hit by large-scale cyberattacks that are forcing the company to temporarily limit new signups. However, existing users can still access the platform without issues. The attacks come after DeepSeek launched a free, open-source large language model that rivals those of tech giants like Microsoft-backed OpenAI (MSFT) and Meta Platforms (META).

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

DeepSeek’s supposedly efficient large language model has sent shockwaves throughout the tech industry, which led to a sell-off in major chip stocks in today’s trading. In fact, Nvidia (NVDA) was hit particularly hard, with its stock plunging over 15% and wiping out $18 billion of CEO Jensen Huang‘s net worth. Other chip makers, including ASML (ASML), Broadcom (AVGO), and Advanced Micro Devices (AMD), also saw significant declines.

Interestingly, though, while analysts at Wedbush Securities believe that DeepSeek’s emergence will be seen as a threat to U.S. tech dominance, they argue that U.S. companies are focused on achieving artificial general intelligence and building a supporting ecosystem. Although DeepSeek’s model is impressive, the analysts believe that U.S. tech companies have a significant advantage in terms of infrastructure and expertise.

Which Stock Is the Better Buy?

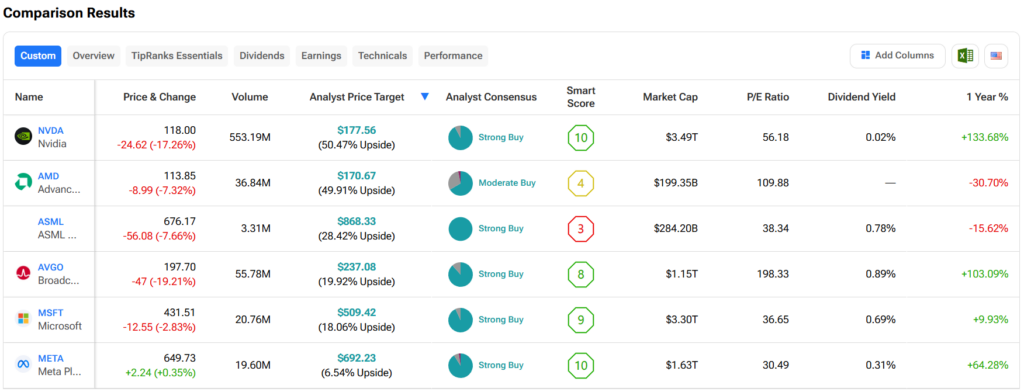

Turning to Wall Street, out of the six stocks mentioned above, analysts think that NVDA stock has the most room to run. In fact, NVDA’s average price target of $177.56 per share implies more than 50% upside potential. On the other hand, analysts expect the least from META stock, as its average price target of $692.23 equates to a gain of 6.5%.