Super Micro Computer (SMCI) is facing a crisis of confidence in the markets, with the company under pressure due to delayed filings and allegations of accounting inconsistencies. However, after reporting preliminary earnings results last week, the stock shot up by double digits as investors were pleased with the bold 2026 guidance. By the week’s close, SMCI was up 18% at $47.91 per share, propelling the stock to a stunning 57% gain so far in 2025.

That being said, I’m taking a neutral stance on the stock for now. Beyond the regulatory uncertainty are concerns about recent delays in new technology components. The company had to lower its guidance for FY 2025, highlighting some struggles in scaling new technologies and raising doubts about its ability to hit long-term targets.

In hindsight, my bearish stance could be too harsh if ongoing regulatory issues do not metastasize into something damaging for the firm. Super Micro remains well-positioned for strong growth over the next two years, but even if it doesn’t hit all its targets, getting somewhere close will likely lead to upside price catalysts, given the stock’s chequered past.

Primed to Lead as the Backbone of AI Infrastructure

Super Micro is clearly positioned as one of the top players in the AI space. To give you some context, the Californian computer tech manufacturer specializes in building high-performance servers essential for data centers—the backbone of AI infrastructure. For instance, SMCI’s servers are often used to power AI platforms that rely on Nvidia GPUs, including machine learning solutions and the race to develop the world’s first artificial general intelligence (AGI) solution.

What sets Super Micro apart, though, is its ability to customize components for clients. Thanks to its innovative liquid-cooling technology, the company also offers smart options to save on power and operating costs. With its strong partnership with the leader in AI, Super Micro is well-positioned to stay at the top as AI continues to grow. Plus, with the ramp-up of Nvidia’s (NVDA) Blackwell GPU servers, fiscal 2026 is shaping up to be a massive inflection point for SMCI.

Is SMCI Biting Off More Than It Can Chew?

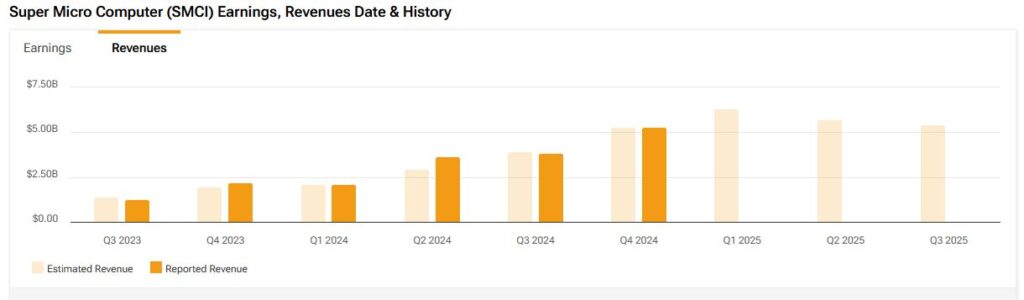

One key takeaway from Super Micro Computer’s preliminary earnings results was CEO Charles Liang’s guidance for FY2026. SMCI expects to hit $40 billion in revenue over the next two years, driven by increased production capacity and strong customer interest in new GPU platforms. However, I have some reservations.

For context, in Q4 2024, Super Micro’s outlook suggested a revenue range of $26-30 billion for FY2025, with the midpoint being $28 billion. However, in Q1, the company lowered its revenue forecast, cutting the high end of its FY2025 guidance to $25 billion — a noticeable slowdown.

The management team pointed to delays in the launch of Blackwell and Hopper products as the main reason for the change. While Super Micro was ready to launch with liquid cooling and had other parts of the technology set up, some key components weren’t ready in time. This shows how much operational delays can disrupt a company’s plans if everything isn’t well-coordinated.

Delays can seriously impact tech companies’ performance, especially in sector niches where being first to market is crucial. Considering this, I think the $40 billion target for FY 2026 could be too ambitious. Hitting that target would require Super Micro to grow at rates of at least 50% year-over-year, which will be a tough challenge.

SMCI Investors Have Clear Catalyst in Sight

Although the stock is climbing so far in 2025, SMCI has dropped by almost 40% over the past 12 months. Volatility in SMCI stock is high, with plenty of speculators plying their trade. Given the uncertainty around its financial reporting, it seems that many long-term investors are hesitant to embrace SMCI. What is great for speculators is rarely good for the long-term value investor.

Recently, Super Micro has struggled with significant delays in filing its audited financial statements, raising concerns about its financial reports’ accuracy and completeness. Things got worse when Hindenburg Research, a well-known short-seller firm, published a report alleging financial irregularities and questionable business practices at the company. It’s worth noting that Super Micro has dealt with similar issues before. In August 2020, the company settled with the SEC for $17.5 million over widespread accounting violations.

NASDAQ has given Super Micro a firm line in the sand. The company must meet the NASDAQ deadline to file its audited results by February 26th to address investor concerns about its financial transparency once and for all.

The key outcome of filing on time would likely be preserving essential partnerships with major AI players like Nvidia and Advanced Micro Devices (AMD), which are crucial for Super Micro’s long-term growth projections. If they meet the deadline, it could show these companies that Super Micro is a stable and reliable partner, which would boost investor confidence. A failure to meet the deadline opens up the possibility of SMCI being delisted, which would likely spur heavy selling as investors lose faith in the stock.

Is Super Micro Computer (SMCI) Stock a Good Buy?

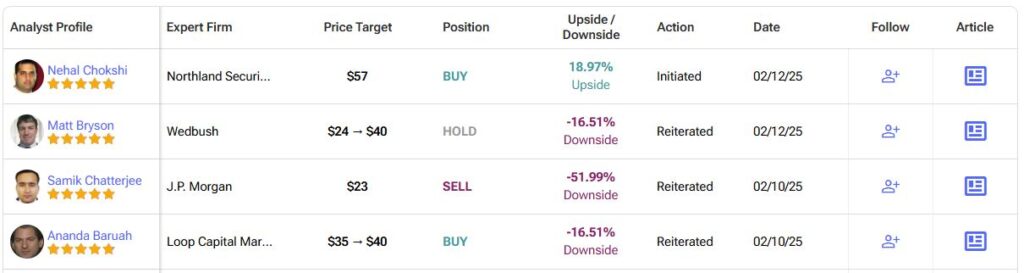

On Wall St., the consensus on SMCI stock is a Moderate Buy, with three analysts bullish, three neutral, and one bearish. However, following the preliminary results, the outlook and SMCI’s share price both shifted. The consensus now sees no further upside—quite the opposite, actually. SMCI’s average price target is $38.40 per share, which suggests a potential downside of almost 20% from the current share price. Following a stellar Q4 earnings beat, it would seem Wall St. is expecting a reversal.

SMCI’s Scalability Dilemma Creates Uncertainty

Despite the regulatory hurdles around Super Micro, the company is undeniably well-positioned in AI’s secular growth, and the strong 2026 guidance backs that up. I believe data centers and AI are still far from seeing a decline in demand. In fact, this might just be the beginning.

The key point is that for Super Micro to hit its long-term goals, it needs volume and scale, especially since its business doesn’t have the high margins that giant software companies do. The lower guidance for FY2025 shows operationally how tough it can be to scale new technologies. This is a yellow flag about the company’s ability to meet its targets, and caution is warranted.

But for now, my main concern is tied to investors’ confidence in the stock, so I take a neutral stance on Super Micro. Moreover, SMCI published preliminary results without filing the 10-K and resolving its ongoing bureaucratic tangle with NASDAQ. The market is anticipating an update concerning this issue, yet SMCI remains tight-lipped. The failure to resolve these side issues seems strange to me, so a wait-and-see approach seems more prudent for now.