Shares of Chewy (CHWY) are up 4% after the online pet retailer’s stock received a double upgrade from Bank of America (BAC).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

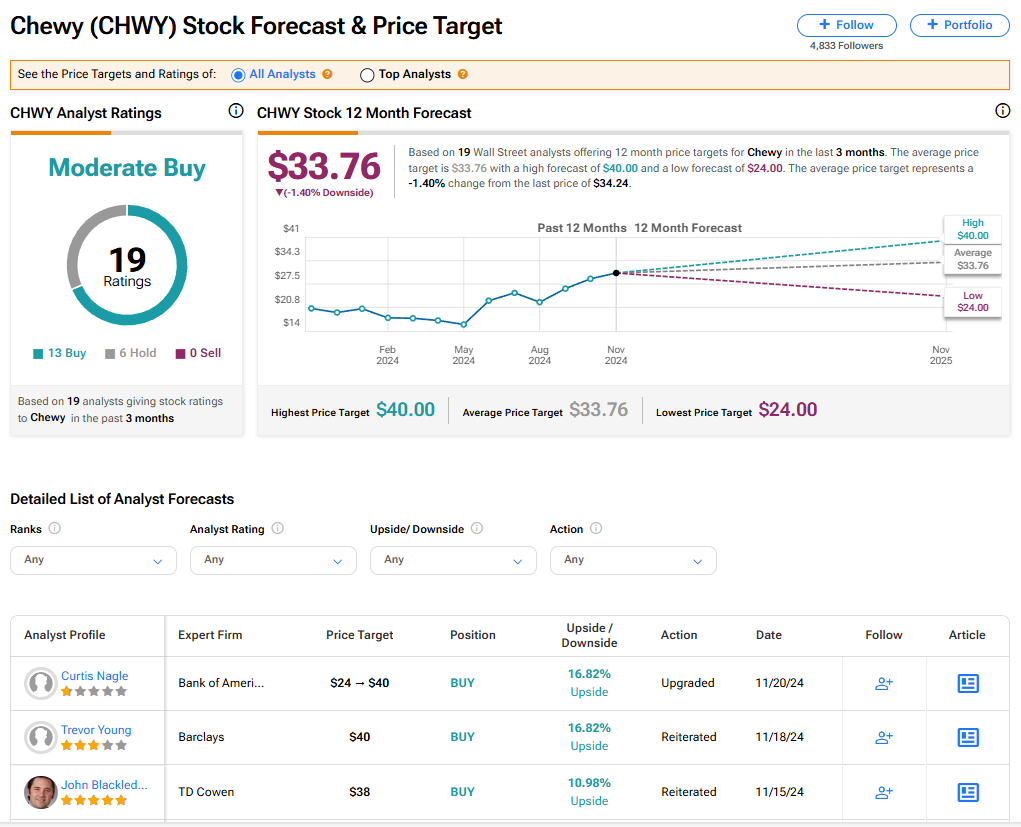

Analyst Curtis Nagle upgraded CHWY stock to Buy from Underperform. He hiked his price target on the shares by 67%, taking it up to $40 from $24. The big upgrade comes amid a rally in Chewy’s stock, with the share price having gained 45% this year.

In his upgrade of Chewy stock, Nagle argued that pet adoption trends are improving in the U.S. and that pet spending appears to have bottomed after years of decline following the Covid-19 pandemic. The analyst added that he expects the pet industry to achieve low-single digit to mid-single digit growth.

Earnings Growth at Chewy

Chewy, which sells pet food and pet-related products exclusively online, saw its business explode during the pandemic. However, in recent years, the company’s sales and stock declined along with the entire pet care industry. Despite this year’s rally, CHWY stock is still 70% below the all-time high it reached in 2021.

Nagle at Bank of America praised the retailer for its cost controls in recent quarters, saying, “Since cost cuts in late 2023, Chewy has demonstrated strong expense discipline in (selling, general, and administrative) and has scaled fulfillment expenses.” Nagle added that investors should expect sizable earnings growth from Chewy going forward.

Is CHWY Stock a Buy?

Chewy stock has a consensus Moderate Buy rating among 19 Wall Street analysts. That rating is based on 13 Buy and six Hold recommendations issued in the last three months. There are no Sell ratings on the stock. The average CHWY price target of $33.76 implies 1.40% downside from current levels.