Shares of Chembio Diagnostics, Inc. (CEMI) soared 159.2% on the news that the company had bagged a $28.3 million purchase order for its DPP SARS-CoV-2 Antigen tests from Bio-Manguinhos of Brazil. The order will be executed in 2021 to support the urgent needs of Brazil’s Ministry of Health in addressing the COVID-19 pandemic. Shares closed at $5.34 on July 21.

Chembio Diagnostics develops, manufactures, markets, and licenses rapid point-of-care diagnostic tests that detect infectious diseases including the COVID-19 virus, HIV, and Ebola. All of its DPP rapid tests have received the necessary approvals from the authorized regulatory bodies. (See Chembio Diagnostics stock charts on TipRanks)

The company’s DPP SARS-CoV-2 Antigen rapid test detects the presence of COVID-19 infection in just 20 minutes using a minimally invasive nasal swab.

Bio-Manguinhos is a unit of the Oswaldo Cruz Foundation (Fiocruz) that develops and produces vaccines, diagnostics, and biopharmaceuticals primarily to meet the demands of Brazil’s national public health system. The company received regulatory approval from Agência Nacional de Vigilância Sanitária (ANVISA) in March 2021.

Both Chembio and Bio-Manguinhos have had a long-standing relationship, wherein Chembio has delivered multiple products for point-of-care detection of COVID-19 antibodies, HIV, and other infectious diseases.

Javan Esfandiari, Chembio’s Executive VP, Chief Science & Technology Officer, said, “Enabling providers to test patients at the point-of-care and determine their infection status in only 20 minutes can be one of the most effective methods for controlling the spread of COVID-19 and improving patient outcomes.”

Chembio made huge investments in the DPP SARS-CoV-2 Antigen test inventory earlier this year and plans to boost its production capacity.

However, Chembio also cautions of not meeting the requirements of the full value of the purchase order due to supply chain disruptions, staffing and liquidity limitations, and other matters outside of its control.

After the huge surge in Chembio’s stock price yesterday, Colliers Securities analyst Kyle Bauser downgraded the stock to a Hold from a Buy.

Bauser stated that the current inflated share price did not justify the company’s growth rate, lack of profitability, and poor performance over the last several quarters. He assigned a price target of $4 to the stock, which implies 25.1% downside potential to current levels.

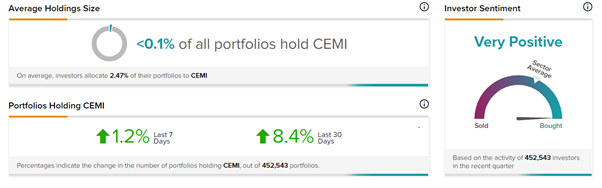

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Chembio Diagnostics, with 8.4% of portfolios tracked by TipRanks increasing their exposure to CEMI stock over the past 30 days.

Related News:

Moderna Partners with Takeda and Govt. of Japan for 50M Vaccine Doses

NeuroMetrix’s Quell Receives Device Designation from FDA; Shares Skyrocket 208%

Intel’s Mobileye Tests Self-Driving Cars in New York; Shares Rise