EV charging infrastructure company ChargePoint (CHPT) is set to report its Q2 earnings results on September 4 after the market closes. Analysts are expecting earnings per share to come in at -$0.15 on revenue of $113.5 million. This equates to a 57.1% increase in EPS but a 24.2% decrease in revenue on a year-over-year basis.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

It’s worth noting that CHPT has had a mixed track record when it comes to beating earnings. In fact, it has only exceeded estimates six times during the past 14 quarters. And arguments made by analysts don’t really inspire too much hope.

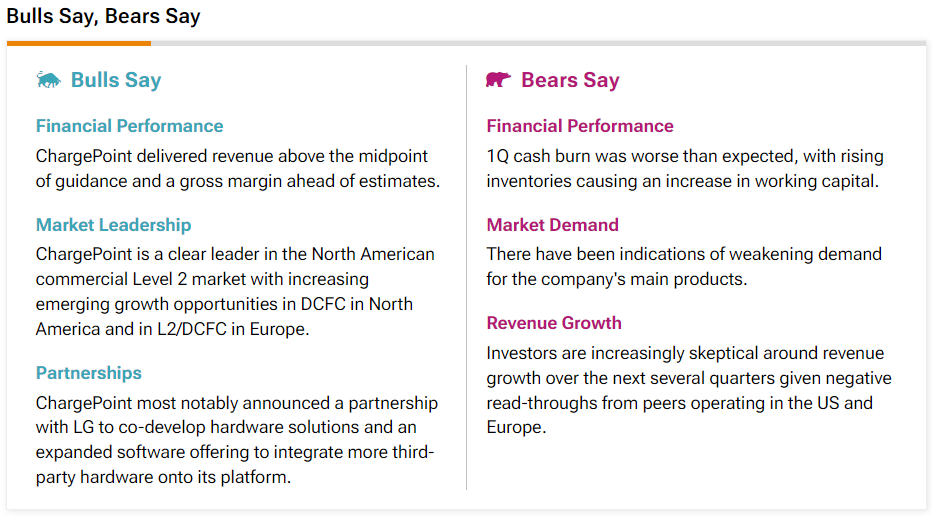

According to TipRanks’ “Bulls Say, Bears Say” tool, analysts point to the company’s financial performance, with the bulls noting that revenue and gross margin came in ahead of expectations. Furthermore, they see the firm as the clear leader in the North American market. However, the bears highlight how Q1 cash burn was worse than expected with rising levels of inventory. In addition, weakening market demand is leading to skepticism around revenue growth.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. Indeed, the at-the-money straddle suggests that options traders expect a large 19.15% price move in either direction. This estimate is derived from the $2 strike price, with call options priced at $0.13 and put options at $0.23.

Is CHPT Stock a Buy?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CHPT stock based on six Buys, five Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 74% decline in its share price over the past year, the average CHPT price target of $3.09 per share implies 64.36% upside potential.